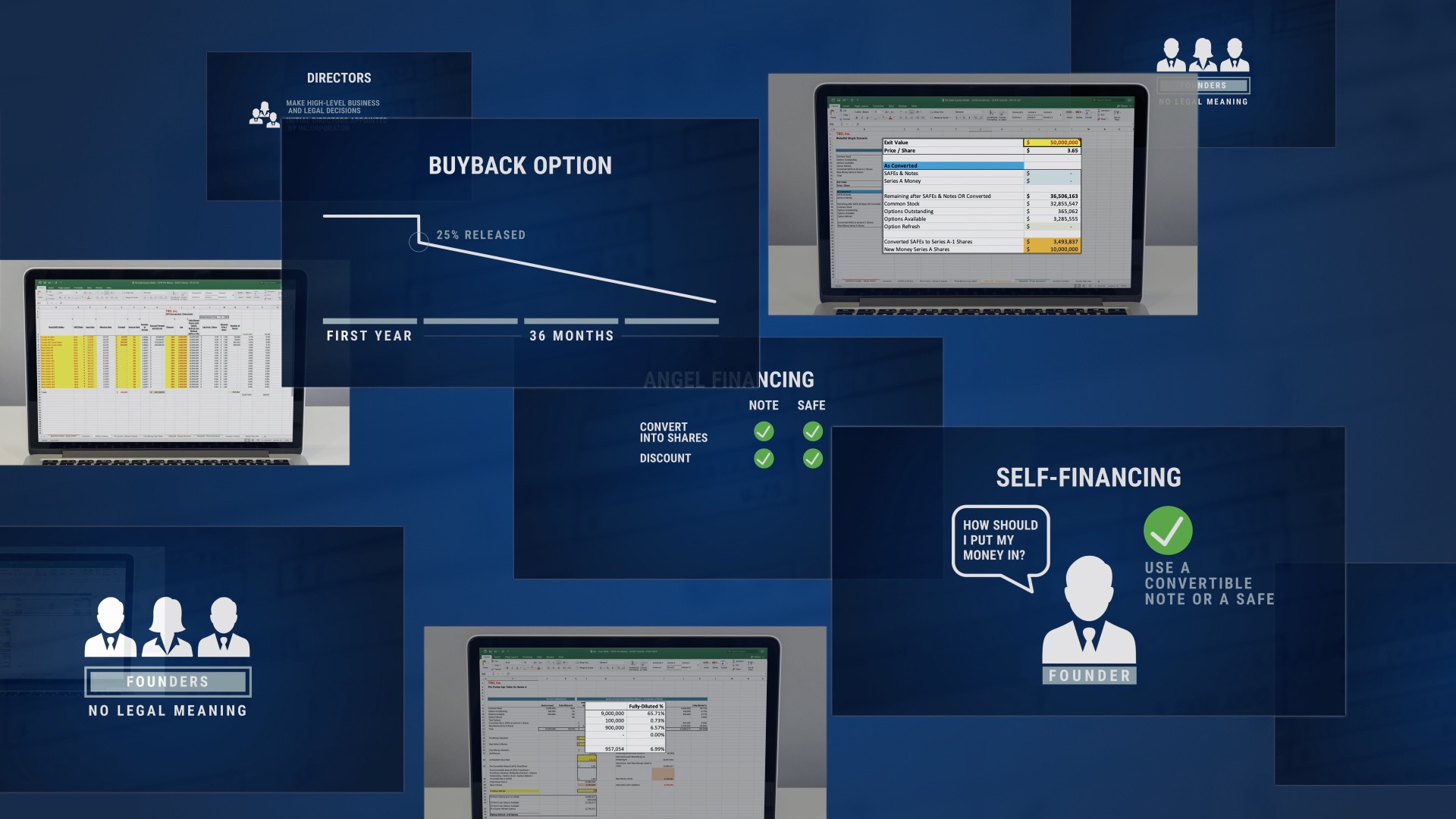

Whether it’s your Uncle Bob’s pocket money from selling a Chevy or a more significant investment from your friend’s professor’s brother who happens to be an angel investor, early investments in your startup may come from surprising places. Regardless of where the money comes from, one of the most common methods to document the investment for pre-revenue and pre-product startups is by using some form of convertible instrument.

Financing

StartupProgram.com Academy Now Included With New Brex Accounts

When founding a company, it’s all too easy to get personal finances and your startup’s accounts co-mingled. And that’s a bad thing for a number of reasons, including that it makes it difficult to track your company’s spending and can cause huge headaches come tax time. To help solve this problem, StartupProgram.com has partnered with Brex, one of the leading financial services companies for startups, to empower entrepreneurs with startup-focused financial tools for their early stage companies. A Brex cash management account with corporate card provides detailed spending reports, offers free wire transfers, integrates with third-party accounting and expense reporting services, and much more. And when you open a Brex cash management account and corporate card, StartupProgram.com will give you one year of access to StartupProgram.com Academy at no charge. This combination of the right financial tools and the knowledge you need to make good financial decisions can greatly improve your startup’s chances of success. The Complete Startup Education to Prepare for Venture Capital The free one-year enrollment in StartupProgram.com Academy includes all three lecture series – Venture Economics 101, Venture Law 101 and the Startup User’s Guide – as well as all three StartupProgram.com cap tables. Additionally, you’ll have … Read more

What is an Angel Investor?

For decades on Broadway, well-to-do patrons of theater would reach into their own pockets to back shows or talent they liked, giving productions a shot at success instead of facing failure even before opening night. These rich theater patrons were called “angels,” and, in a 1978 paper on funding of entrepreneurs, University of New Hampshire professor William Wetzel broadened the term to describe investors willing to invest their own money into entrepreneurial companies. Angel Investors and Modern Startups In the world of startup companies, an angel is an early investor who can help bridge the gap between “friends and family” funding and a Series A funding with venture capitalists. While venture capitalists manage funds pooled from numerous investors, an angel is usually an individual who invests his or her own money. Sometimes, groups of angel investors work together on investment deals. An angel investor may want to work with startups for more than monetary reasons. For example, an angel may be a retired executive who wants to stay involved in her industry, or a former entrepreneur who hopes to help out a new generation of startup founders. Angels usually invest during seed rounds, and in amounts much smaller than venture … Read more

What is a Cap Table? Why is It Important?

“I’m an entrepreneur because I like working with spreadsheets,” said very few startup founders ever. But all founders need to embrace at least one spreadsheet: their company’s cap table. A cap table – formally, a capitalization table – seems simple on a basic level: it’s the current record (usually in Excel form) of equity ownership in a company. A cap table lists all the persons who currently own shares, warrants, options, convertible notes, or SAFEs of a company, and the value of that equity, adding up to the total market value of the company. In practice, cap tables can get complex quickly. Once a company moves past the early stages and adopts a stock incentive plan or takes on different investment instruments such as convertible notes and SAFEs, the founders will begin facing dilution, which means their ownership percentage in the company will begin to change as the company’s shareholders increase. These different factors layered with variables such as individual vesting schedules, means that the job of answering the question of “who owns what?” when considering the company’s ownership is no longer a simple calculation. As a founder or co-founder you do not want just any cap table solution, but … Read more

What Is a Venture Capitalist?

It’s a familiar story: a venture capital firm invests in a small technology startup that goes on to see huge growth and an eventual sale to a large tech company like Facebook or a successful IPO, giving the venture capital firm a massive return on its initial investment. Although that may sound like a scenario exclusive to dot-com booms and startups in the 21st Century, it’s also the story of American Research and Development Corp. and its 1957 investment in Digital Equipment Corp. (DEC), which arose in the Boston area, not Silicon Valley. Led by Georges Doriot, often called ”the father of venture capital,” ARDC’s $70,000 investment in DEC grew to $355 million — 500 times ARDC’s initial investment — when DEC held its initial public offering in 1968. (For a great biography of Georges Doriot, please read Creative Capital: Georges Doriot and the Birth of Venture Capital, by Spencer E. Ante.) Although they’ve been around a while, the lore of venture capitalists (or VCs) is most strongly tied to the startup culture that first emerged from Silicon Valley in the late 1990s and continues to this day. You may have heard heady tales of fantastic riches (and disastrous dot-com … Read more