More than any other tool, your cap table is essential to planning the formation of your business and charting its financial future. StartupProgram.com’s cap table – we call it the Debt Equity Model – is laser-focused on providing founders of venture-backed companies the best possible insight into their future finances.

Cap Table Basics

A capitalization table, traditionally a spreadsheet, sets forth each person’s stock ownership and ownership percentage in a company. A pro forma cap table models the effect of selling stock or convertible notes and SAFEs on share price, dilution to the existing stockholders, and the potential outcomes for the investors in a sale of the business. Consulting your cap table and running pro forma scenarios for each financing is critical when negotiating with venture capitalists and other investors — without thoroughly understanding the impact of investment on your cap table during your negotiations creates a risk of handing over too much control of your company to your investors and reducing the founder’s and current stockholder payoff when you sell your business or go public (IPO). What’s more, venture capitalists will want to review your cap table to understand your company’s equity distribution before investing in your company. In other words, you can think of your cap table as a window into your company’s financial soul.

Perhaps just as important, though, is that your cap table will force you to think through many important issues when you’re forming your startup. Preparing a cap table when you form your company is a key to your success and to avoiding costly mistakes because it requires you to consider things such as:

- When I form my company, how many shares should I authorize and should there be different classes of stock?

- How many shares should be issued to myself and my fellow founders?

- Should I set up a stock incentive plan for employees?

Your answers to these and other questions raised by your cap table will affect your company at formation, during financing rounds, and ultimately when you exit.

Our Uniquely Powerful Cap Table

SUP’s cap table isn’t just theoretical modeling. Created by investor and startup attorney Dan Offner, the SUP cap table has been battle-tested over decades of experience helping startups plan and run their companies. Offner, founder of StartupProgram.com and Los Angeles law firm O&A, P.C., developed SUP’s Debt Equity Model when he, as an investor, needed to get a clear view into the debt and equity position of startups that he was potentially going to invest in. Since then, Offner has used the Debt Equity Model to help launch dozens of startups, close dozens of financings and company sales, as well as fix the mistakes of founders who didn’t take the time to prepare a proper cap table before negotiating with angel investors and venture capital funds.

And although you can find other cap tables and cap table services on the internet, the StartupProgram.com Debt Equity Model has a number of features that make it the clear choice for entrusting your startup’s financial planning:

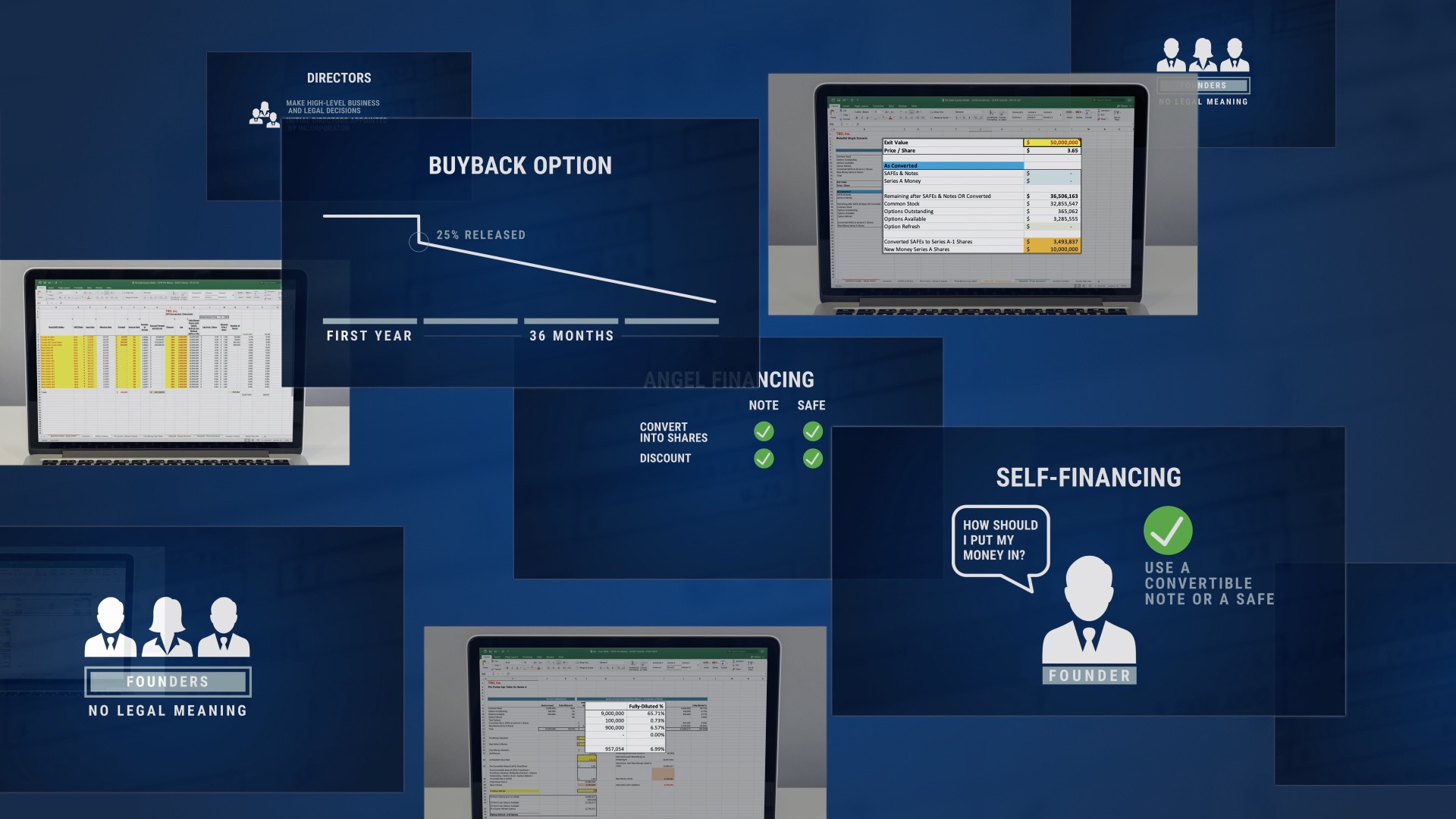

- Our scenario modeling engine provides an accurate view into how changing the cap and discount on a SAFE or convertible note can change the number of preferred shares it will convert into — and ultimately the percentage of the company that these investors are purchasing

- Dilution calculations across the board: from angel investing to your stock incentive plan to a Series A round, our cap table provides an accurate calculation for how much each employee, advisor, and investor will dilute your equity in the company

- Custom vesting schedules, which shows you how many shares have vested at any given time for any employee, contractor, adviser or founder

- Our cap table is a downloadable spreadsheet, not a web site – so you can make calculations anywhere (and there’s no monthly fee)

The Three Versions of Our Cap Table

In order to meet the fast-changing dynamics of the startup-financing world, the StartupProgram.com Debt Equity Model cap table comes in three versions to address the different types of convertible notes and SAFEs that have become standard documents in the venture capital world:

Traditional (Pre-Money SAFEs): This cap table version is for use with pre-2019 Y-Combinator SAFEs and the original 500 Startup KISS agreement forms, what we have dubbed as “pre-money SAFEs.”

Post-Money SAFEs: This cap table is for use with the Y-Combinator’s post-money SAFEs introduced in 2019 and any other convertible note based upon these SAFEs.

Y-Combinator Stake: This version of the cap table is designed for use with Y-Combinator post-money SAFEs introduced in 2019 and for any SAFE or convertible note that guarantees an investor a fixed-percentage ownership prior to the issuance of preferred stock in a Series Seed or Series A.

Which one do you need? If you’re unsure and you’re starting a new company, we recommend you adopt the new post-money SAFE for your angel investors, so you will need the Debt Equity model for post-money SAFEs. If you have already issued a SAFE prior 2019 or are using the KISS forms, the Traditional model cap table is likely the most applicable version. If you have been admitted to an accelerator such as Y-Combinator or promised an angel investor certain fixed-percentage ownership, you will need the Y-Combinator Stake cap table.

Learn How to Use Your Cap Table

Although the StartupProgram.com cap table is a powerful tool for forming and running your company, knowing how to properly use it is even more important. That’s why we created StartupProgram.com Academy, an interactive online learning series designed for use alongside the SUP Debt Equity Model.

This video lecture series, which includes all three versions of the cap table when you enroll, walks you through each tab of the cap table and the choices you’ll need to make – not just to fill out the cap table, but to plan for the future of your business. You’ll learn the value of a stock incentive program, how to properly put your own money into your startup, how dilution works, and more.

We’ll go into detail about the StartupProgram.com Academy in a future blog post, or you can read more about it on the StartupProgram.com Academy page.

To download your cap table now, select the version you’d like from the list below. As a bonus, we’re including a free lecture from one of our StartupProgram Academy classes with your purchase.