Issuing stock to founders, employees, contractors, and advisors is the primary way to compensate a startup’s team when there’s little to no revenue coming in to pay salaries. That said, it can sometimes be necessary for you to explain that the value in being a shareholder doesn’t come from the value when issued, but from the value when their stock is sold – the potential of a huge payday when a stock’s value skyrockets at an exit can help attract and retain talent.

There are many ways to issue stock, and the methods and restrictions that can be put in place may sound confusing. Read on to learn about the most common ways startups get equity into the hands of founders, advisors, contractors, and employees, and how to keep each one of these people honest and committed to the success of the startup.

Stock Purchase

A stock purchase is exactly what it sounds like — someone pays the corporation to purchase their stock.

For startups, the first stockholders are the founders, which will usually receive their stock through a stock purchase agreement. The founders will purchase a majority of the company’s common stock at formation by paying both cash and assigning intellectual property they created for the startup (e.g., inventions, websites, logos, domain names, source code, etc.). Because the startup has essentially no value at its formation, the founders can purchase each of their shares for a fraction of a penny — as an example, a founder’s purchase of 4.5 million shares priced at $0.00001 per share tallies up to $45.

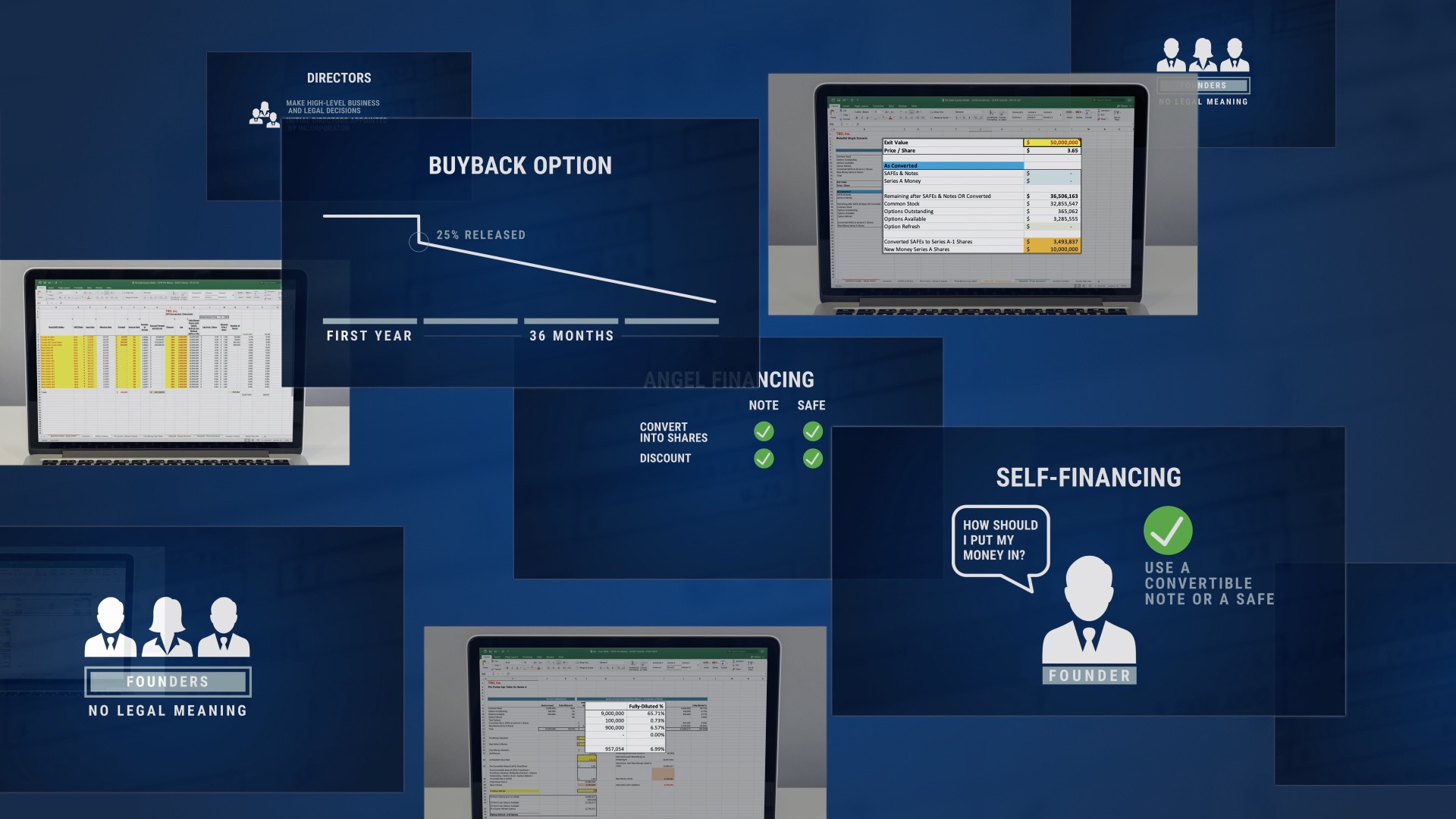

However, a startup that hopes to one day attract venture capital funding will sell its founders shares with restrictions to keep each founder engaged and committed to growing the value of the company. Some of these restrictions include an option for the company to buyback or repurchase the shares if the founder leaves before a certain period of time has passed. The inclusion of the buyback or repurchase right in the stock purchase agreement causes some people to call these agreements restricted stock purchase agreements (RSPA). The buyback/repurchase right is what we call reverse vesting. What this means is that each of the founders own all of their shares outright on the date they buy the shares, they can vote all of the shares and are entitled to receive dividends on each share they have, but in the event they leave earlier than what is set forth in the vesting schedule in the RSPA, the founder will forfeit any unvested shares back to the company. Over time, typically on a monthly basis, the number of shares the company has the right to buy back becomes smaller, which is why this is called reverse vesting. With vesting as it is typically understood, each month the shareholder would be granted additional shares, each of which is treated as a taxable event and so the shareholder would need to calculate the fair market value of the stock and their taxable income every month! It is therefore usually tax efficient to structure as reverse vesting instead of traditional vesting.

Venture capitalists will only invest in companies with founders who are willing to have their stock subject to some form of vesting because it creates a disincentive for a founder to leave before the investor might see a return on their investment. VCs want to work with motivated founders committed to the company, not founders who can leave with all their shares and profit off of the work of those who remain. VCs also invest based on a pre-money valuation that often relies upon the expertise and talent of the founders, and so their leaving the company immediately after the funding undercuts the startup’s value.

Additional stock purchases can be conducted through the stock incentive plan, a pool of reserved shares that can be used for distributing shares to advisors, contractors and employees. Often you’ll see RSPAs issued to employees, contractors, or advisors from the stock incentive plan with similar, if not the same, reverse vesting terms as the founders. This gives the founding team peace of mind that the employees are incentivized to continue working for their equity over time or at least until their vesting schedule has been completed. The most popular time frame for a vesting schedule is four years with a one year cliff (meaning the employee’s shares will vest over a four year period, but the first 25% of those shares will vest on the first anniversary of their employment with the company and monthly thereafter). Vesting is also a key concept because if your CFO leaves halfway through her vesting period, half of her shares are repurchase and reallocated to the stock incentive plan so that you can use them to compensate the replacement CFO.

What is a Stock Option?

A stock option is an agreement that allows a person to purchase shares of a corporation’s common stock at a fixed price (the “exercise” or “strike” price). Unlike an RSPA, an option holder cannot vote using their shares or receive dividends until they exercise the option and purchase the shares – only then can they vote and receive dividends on the exercised shares (and not the other options that have not yet been exercised).

The term “option” more or less refers to the “option” to purchase stock in the company whenever it is convenient for the option holder. Typically, a stock option will have an expiration date that is ten years from the date of issuance, and so there is a lot of discretion afforded to the option holder. The key reason you would want to issue stock options instead of an RSPA is that the fair market value of the stock is too high for the grantee to purchase all their shares up-front. For example, in a startup with 10M shares, and a $10M valuation (so $1/share), granting 1% (or 100,000) shares would require a payment to the company of $100,000 under the RSPA. Under this example the stock option’s exercise price cannot be lower than $1/share because that is the fair market value as of the time of grant, but it can be exercised in any number of installments over a (typically) ten year period.

While stock options can be issued without a stock incentive plan, it is much more burdensome than if you had first set up a stock incentive plan. The main reason is that a stock incentive plan makes it much simpler for your issuances from the plan to be compliant with state and federal securities laws.

A stock option can be issued in one of two forms:

- Incentive Stock Options (“ISOs”) – A type of stock option that can be granted to employees only in order to qualify as a “Statutory Stock Option” to receive tax-favorable treatment. When an ISO is qualified, it is not subject to ordinary income taxes at the time of grant or exercise; rather only the profit from selling underlying shares is taxed. Therefore it is typically the more tax efficient option, but again it is only available to employees.

- Non-Qualified Stock Options (“Non Quals” or “NQSOs”) – If a stock option grant does not qualify as an ISO, then it is an NQSO. NQSOs can be granted to employees, contractors, and advisors, but have a less favorable tax treatment than ISOs. A holder of an NQSO does not recognize any income on the grant of the NQSO, but instead recognizes ordinary income equal to the difference of the exercise price and the fair market value on the date the option holder exercises the NQSO and again as capital gains when the option holder sells the stock.

Keep in mind that issuing stock from a stock incentive plan can carry a tax burden for your employees, whether upon exercise if they have options or via a stock purchase agreement. With that being said it’s advised to have legal counsel review your stock incentive plan before adoption and advise on best practices to ensure financial efficiency and safety for both the company and its stockholders.

What is a Stock Grant?

A stock grant is the issuance of stock in exchange for non-cash consideration, such as services performed.

For startups, stock grants are commonly used to compensate employees through stock incentive plans. As with founders’ shares, stock grants to employees should be subject to vesting, doling out ownership of shares over time in order to motivate staff to stick around. Specifically, grants should be subject to a buy-back option via a restricted stock grant agreement (RGSA) – the employee is granted all the shares at once, but the company maintains the option to buy back non-vested shares if the employee leaves. Grants structured with this reverse vesting restriction are more favorable for the employee at tax time, just like with RSPAs. However, if the startup is organized in certain states, including California, it is impossible to make stock grants because those states view them as an unfair way companies can avoid paying compensation to their employees. Therefore, stock grants are the least common type of stock issuance.

Learn How and When to Sell, Option or Grant Stock from Your Startup

Equity is the lifeblood of a startup, and how you manage stock purchases, options, and grants is an essential skill that can be the difference between success and failure. StartupProgram Academy (SUP Academy), our interactive online lecture series, will teach you how to set up a stock incentive program, how founders’ shares should be issued, whether you should sell stock to Uncle Bob (most likely not, unless its from a stock incentive plan), and more.

SUP Academy explains how to use the StartupProgram debt equity model (aka cap table), our exclusive tool to track all your company’s equity, including who owns how many shares, and when their ownership takes effect. Without a well-maintained cap table, founders risk discovering too late that they’ve become minority shareholders who have lost control of their company before they make an exit.

StartupProgram’s Professional Services can handle the heavy lifting of creating and filing the documents to form your company, including those needed to set up a stock incentive plan and issue shares to founders and initial hires. Perhaps more importantly, though, SUP Professional Services includes a review of your cap table by its partner law firm O&A, P.C., helping to ensure that you’ve set up your early equity distributions properly, with an eye on using company stock effectively and preparing your startup for venture capital investment.