“Fully Diluted” is a phrase often thrown around when discussing a company’s capitalization. But what does it really mean? Understanding your company’s capitalization is critical during any stage of the company’s lifecycle, not only to maintain an intimate understanding of current overall ownership, but also as a way to gauge whether a potential investment is worth the equity you’d be giving up in return.

Similarly, any investor will require a detailed understanding of how much of a company they are getting in exchange for their money. Learning how the concept of “fully diluted” plays into these measurements is necessary to run a startup, and is an important building block in your overall venture capital vocabulary.

In this post, we will walk you through the basics of fully diluted capitalization and provide a comparison against other methods of analyzing your company’s capitalization. While this post will outline the standard definition and calculation of fully diluted capitalization, please be aware that in any given transaction document, fully diluted can be defined and calculated in a different way.

Definition of “Fully Diluted”

In general, there are two main ways to compute your company’s ownership: (1) the number of shares issued and outstanding, and (2) the equity allocated on fully diluted capitalization.

We discussed what “issued and outstanding” means in greater depth in a previous blog post, but, to summarize, shares that are issued and outstanding are those that have actually been granted, exercised, or purchased; in other words, those shares that are already in the metaphorical hands of the shareholders (and we say metaphorical because most companies don’t actually issue physical stock certificates anymore). Issued and outstanding shares do not include allocated stock options and grants that have not been exercised, unexercised warrants, or unconverted SAFEs and promissory notes.

Fully diluted, on the other hand, includes not only those shares that are issued and outstanding, but also any shares attributable to convertible instruments, like SAFEs and promissory notes (calculated by treating these instruments on an as-converted basis), and allocated to the stock incentive plan (SIP), including exercised and unexercised options, stock grants, and warrants. As implied by the name, this method of capitalization takes into account how much your ownership, or an investor’s ownership, is impacted by those convertible or allocated shares — i.e., the full dilution of your equity. For this reason, your company’s fully diluted capitalization is the true reflection of overall ownership of your company, since it takes into account all of the shares that will eventually be considered issued and outstanding.

How to Calculate Fully Diluted Shares

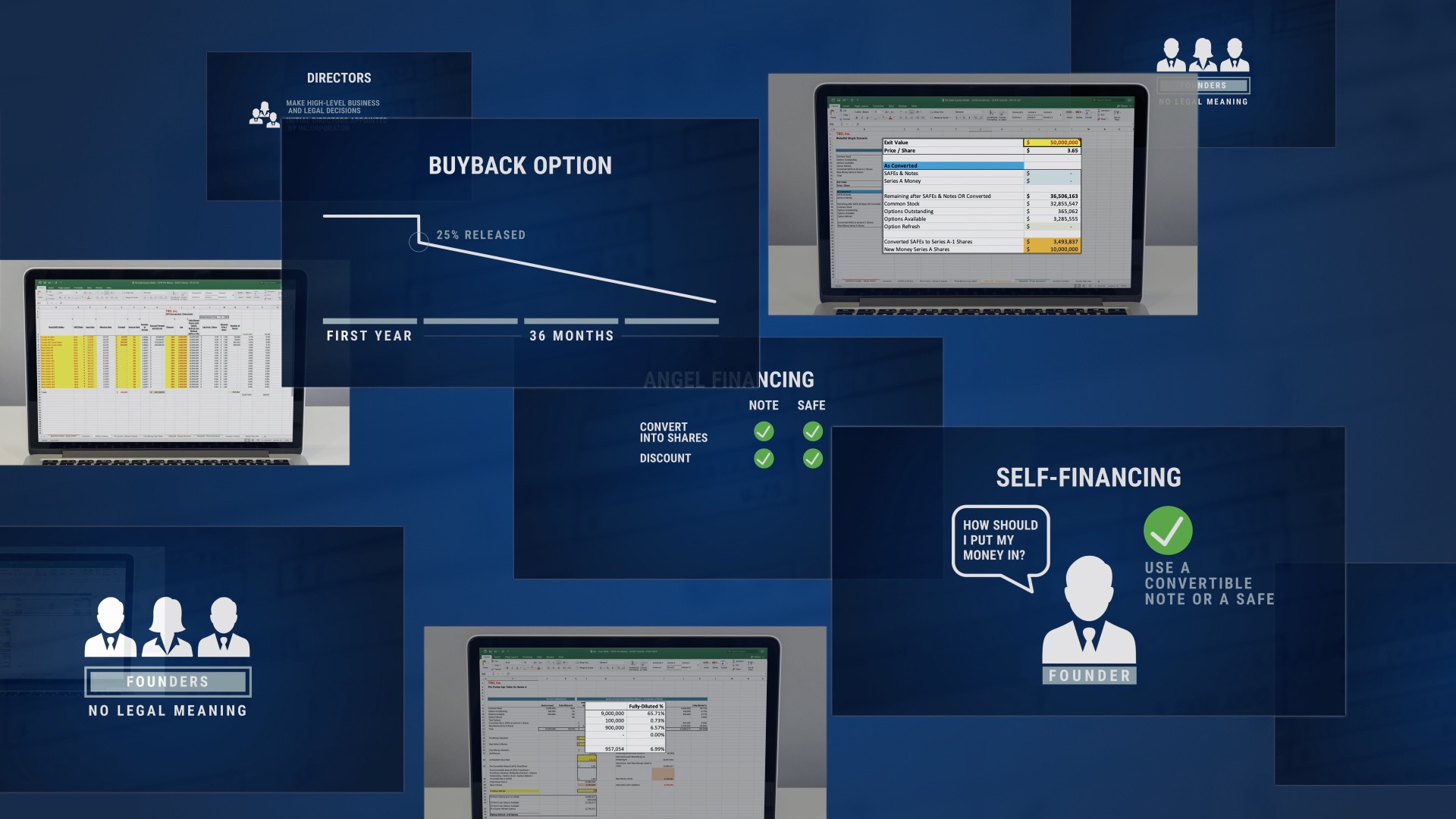

Now that you have a better understanding of fully diluted capitalization, we’ve provided a cheat sheet below to reference when calculating the total number of fully diluted shares in your company.

Total number of fully diluted shares =

Stock issued and outstanding

+ Shares allocated to the Stock Incentive Plan and stock warrants

+ Shares attributable to convertible promissory notes and SAFEs

Example: Fully Diluted vs Issued and Outstanding

When calculating current ownership compared to the potential dilution from future investments or other events, understanding the dilutive impact of the allocated but unexercised shares and convertible instruments is key. To demonstrate this, let’s walk through an example showing a company’s issued and outstanding shares vs fully diluted capitalization. For the sake of simplicity, we are calculating the employee options and SAFEs as a class.

Imagine Company A has:

- 700,000 shares of common stock directly issued and outstanding;

- 250,000 shares allocated to the SIP for the employees, contractors and advisors, some of of which have been exercised and some have not;

- 300,000 shares of preferred stock issued and outstanding; and

- 150,000 shares for SAFEs once converted

Under the issued and outstanding shares calculation, the denominator for any ownership calculation is 1,000,000 shares — the total number of common stock and preferred shares of stock that are actually directly issued and outstanding. For fully diluted capitalization, however, the denominator would include both the issued and outstanding common and preferred stock as well as the allocated shares to the SIP (both exercised and unexercised) and unconverted SAFEs, for a total of 1,400,000 shares.

So, let’s say Shareholder 1 of Company A owns 200,000 shares of common stock, Shareholder 2 owns 500,000 shares of common stock, and Shareholder 3 owns 300,000 shares of preferred stock. In Shareholder 1’s case, based on only those shares issued and outstanding, Shareholder 1 owns 20% of the company (200,000 / 1,000,000). However, when we look at the total shares of Company A on a fully diluted basis, Shareholder 1 owns only 14.3% of the company (200,000 / 1,400,000). If you carry out these same calculations for Shareholders 2 and 3, the results would be similar — each shareholder’s percentage ownership decreases under the fully diluted calculation.

The drop in ownership percentage between the two methods of capitalization is a reflection of the fully diluted capitalization model taking into account the dilutive impact of the other shareholders whose promised equity will eventually become “issued” shares —and, as such, it provides the full picture of your company’s capitalization. The issued and outstanding model, on the other hand, is a method of taking a snapshot of actual ownership at the exact moment in time of the calculation, irrespective of how many shares are promised to others.

While neither method of calculation is superior, both serve to provide shareholders with a deeper understanding of a company’s equity, which can help illuminate the impact of potential transactions and inform overall decision-making.