“I’m an entrepreneur because I like working with spreadsheets,” said very few startup founders ever. But all founders need to embrace at least one spreadsheet: their company’s cap table.

A cap table – formally, a capitalization table – seems simple on a basic level: it’s the current record (usually in Excel form) of equity ownership in a company. A cap table lists all the persons who currently own shares, warrants, options, convertible notes, or SAFEs of a company, and the value of that equity, adding up to the total market value of the company.

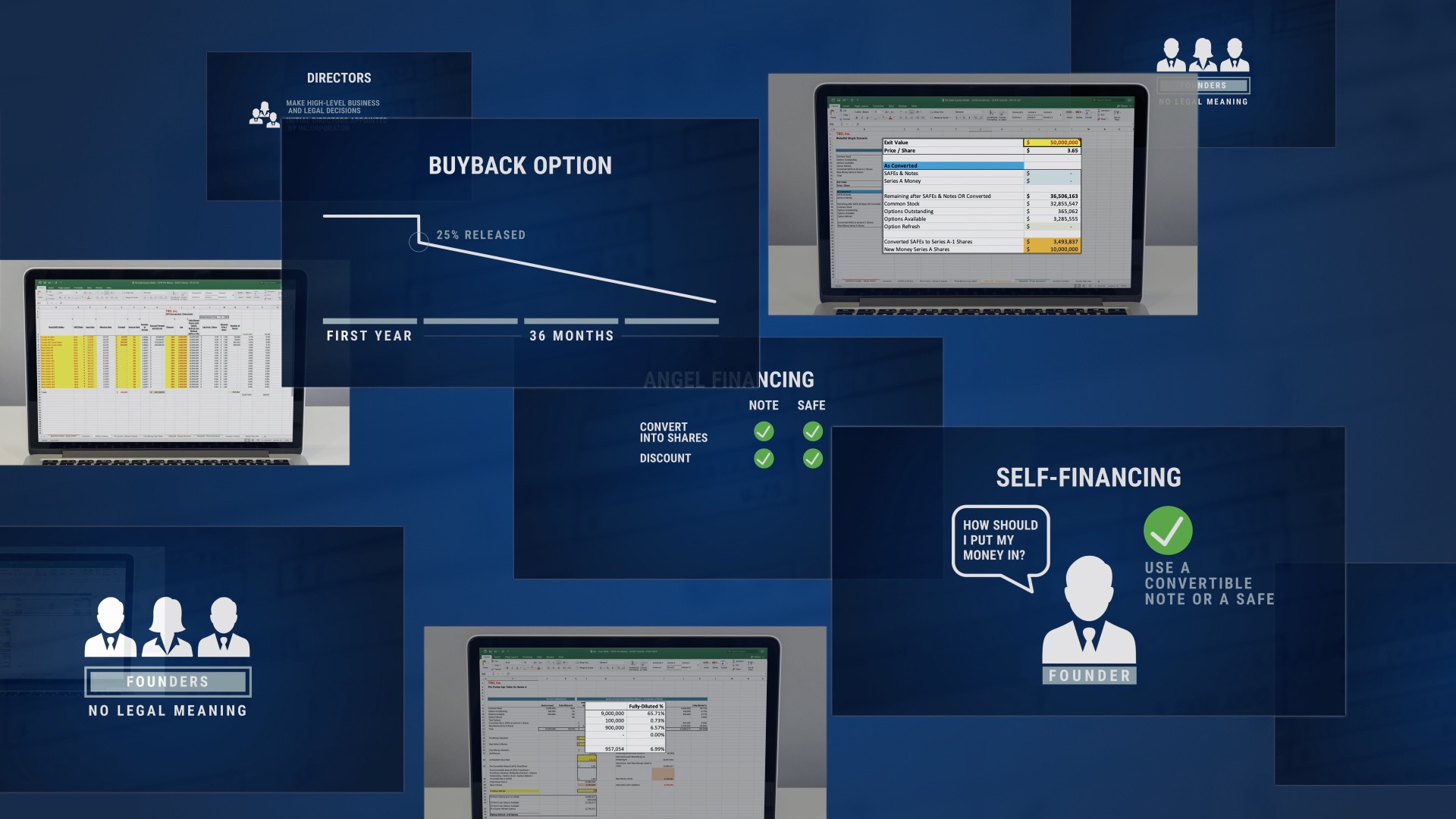

In practice, cap tables can get complex quickly. Once a company moves past the early stages and adopts a stock incentive plan or takes on different investment instruments such as convertible notes and SAFEs, the founders will begin facing dilution, which means their ownership percentage in the company will begin to change as the company’s shareholders increase. These different factors layered with variables such as individual vesting schedules, means that the job of answering the question of “who owns what?” when considering the company’s ownership is no longer a simple calculation.

As a founder or co-founder you do not want just any cap table solution, but one that helps founders model outcomes from potential investments as well as test various exit scenarios (this what is called a pro-forma cap table). A complete, well-maintained cap table can answer a more complete equity question: “Who owns what, how much equity am I giving away when raise a round of financing, how much dilution does each stockholder suffer over time – and what’s my equity worth upon a future exit?”

Why Keeping Up a Cap Table is Important

Although at first glance it may seem the cap table is simply a bit of time-consuming bookkeeping that founders and CFOs update occasionally when bringing on new investors, a cap table is actually the most critical financial tool for startups seeking venture capital.

Without regular consultation of an up-to-date cap table to consider ownership stakes, founders will be making decisions about capital structure, equity grants and fund raising in the dark. Every promise of equity has an impact on your cap table and the future of your return on your investment as a founder. No reasonable decisions on potential angel investors can be made without first understanding the possible impact of these investments on the future ownership structure of the company. It may be great to stockpile cash from convertible notes and SAFEs now, but those investments immediately dilute the founders’ ownership — so they’re left with a smaller percentage. You want to know the impact of each convertible note and SAFE well in advance of negotiating a Series A round and sending out term sheets. If a founder doesn’t, it could stall or even kill the deal because the investor might not like your stewardship of the company or feel you are not adequately incentivized to trudge forward because your equity stake is too small.

By using a robust, well-maintained cap table, a founder can not only see the current ownership distribution but also project how that ownership changes under various scenarios. With a cap table, a founder can consider raising money on convertible notes and SAFEs in the context of what it might mean down the road during a Series A round, always with an eye on dilution.

What’s more, venture capitalists will want to review a startup’s cap table before considering an investment, as will any company that’s considering acquiring the startup. Keeping an up-to-date and accurate cap table is necessary to negotiate and win with VCs and corporate suitors and gets deals done faster.

What’s in a Cap Table

A cap table tracks the entire equity of a company, so as you might expect, it needs to track different kinds of ownership and investments, including:

- Founders’ number of shares of common stock

- Stock incentive plan, often referred to as your stock option pool

- Self-financing (ideally, with a convertible note or SAFE)

- Series A (and subsequent rounds) investment

A key calculation within a cap table is the determination of post-money valuation after a Series A investment: the new market value of the company after the Series A cash infusion and the conversion of debt instruments into shares, and how that breaks down for all the individual shareholders.

Additionally, a good cap table will help founders model exit scenarios and liquidation preferences — a.k.a. a waterfall analysis — the calculation of “who gets how much” when the startup goes public or is acquired (known as a “liquidity event”). With these analyses in the cap table, a founder can project payouts for each level of shareholder or investor (founder, angel, stock incentive plan participant or Series A venture capitalist). Understanding the value of an acquisition offer across the spectrum of investors is invaluable when deciding your business goals and ultimately whether to sell.

The StartupProgram.com Cap Tables

At StartupProgram.com we’ve developed a sophisticated cap table that we call the Debt Equity Model. It includes a number of high-end features that make it the choice for entrusting your startup’s financial planning:

- Our scenario modeling provides an accurate view into how changing the cap and discount on a SAFE or convertible note can change the number of preferred shares it will convert into — and ultimately the percentage of the company that investors will purchase

- Complete dilution calculations: from raising money on convertible notes and SAFEs to your stock incentive plan to a Series A round, our cap table calculates how much each employee, advisor, and investor will dilute your equity in the company

- Custom vesting schedules, which shows you how many shares have vested at any given time for any employee, contractor, adviser or founder

- Our cap table is a downloadable spreadsheet – so you can make calculations anywhere (and there’s no monthly fee, as there is with some web-based cap tables)

The StartupProgram.com Debt Equity Model cap table is available in three versions to address the different types of convertible notes and SAFEs that have become standard documents in the venture capital world:

Traditional (Pre-Money SAFEs): This version is for use with pre-2019 Y-Combinator SAFEs and the original 500 Startup KISS agreement forms, what we call “pre-money SAFEs.”

Post-Money SAFEs: This version of our cap table is for use with the Y-Combinator’s post-money SAFEs (introduced in 2019) and any other convertible notes based upon these SAFEs.

Y-Combinator Stake: This cap table is designed for use with Y-Combinator post-money SAFEs and for any SAFE or convertible note that guarantees an investor a fixed-percentage ownership prior to the issuance of preferred stock in a Series Seed or Series A.

Learn How to Use Your Cap Table

Although a cap table is a critical tool for forming and running your company, knowing how to use one is even more important. That’s why we created StartupProgram.com Academy, a lecture series designed for use alongside our cap tables.

This interactive online series, which includes all three versions of the cap table when you enroll, walks you through each tab of the cap table spreadsheet. You’ll learn the value of a stock incentive program, how to properly put your own money into your startup, how equity dilution works, and more.

To download your cap table now, select the version you’d like from the list below. As a bonus, we’re including a free lecture from one of our StartupProgram Academy classes with your purchase.