People always ask me, “What is SUP?” and “Why is its Debt Equity Model (Cap Table) relevant when I can build my cap table using an online tool?”

Here is my answer!

In the Beginning – Venture Cap Tables

Years ago, I started to angel invest after I had success investing in a company called Oculus, which was sold to Facebook for $2.4 billion in 2014. Back then, most angel investors primarily invested using convertible notes. On one deal with a company called Clutter, I asked the founder for a cap table that showed me and the other holders of convertible notes how much of the company we owned. I got a PDF of an Excel spreadsheet from the founder’s law firm, Orrick, that did not show me much of anything. In particular, it did not show me how our notes converted and how much equity we had after the first round of preferred equity financing. I pressed, I asked, I cajoled – nothing. “I can’t get that from my law firm,” the founder told me, “and if they had to do that work for me, it would cost a lot of time and money.”

“This can’t be,” I said to myself, so I searched online for a model. Back then, I found two sources of help – a site from Naval Ravikant the founder of AngelList, and a site from Brad Feld, the founder of Foundry Group and author of Be Smarter Than Your Lawyer. What is ironic is that only Naval’s site still offers cap table information today. All of the links at Brad’s site, including a link to a page by Mark Suster, a managing partner at Upfront Ventures, are now dead.

Regardless, although these sites and models helped, they did not specifically address the problem head-on for me as an angel investor.

The Problem

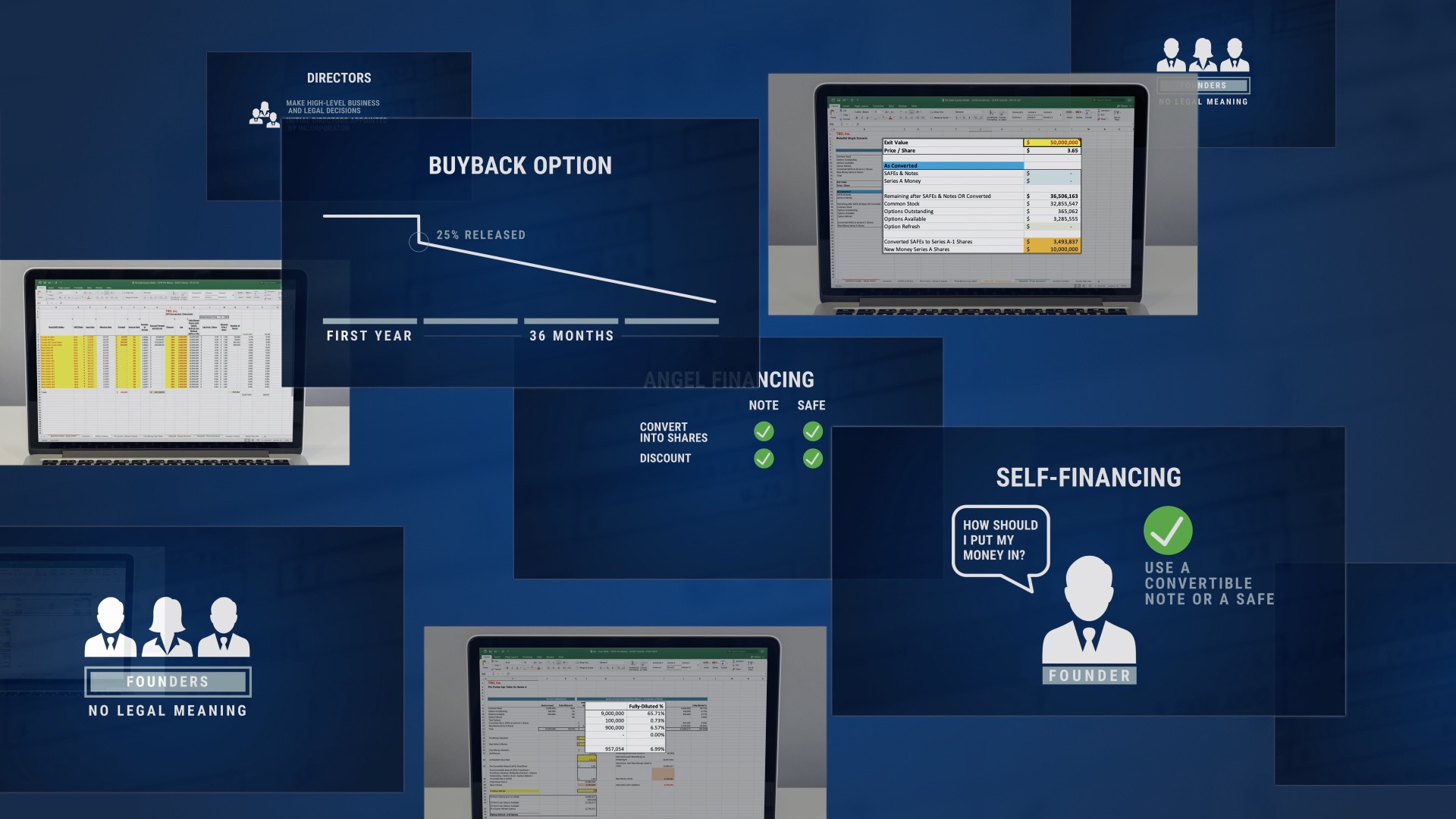

The problem with those models back then and still today was that none of them adequately handled the Clutter issues, which are all startup companies’ issues. Specifically, I wanted something that would address the following:

- How much equity should the founders give to themselves and the stock incentive plan?

- How did the notes convert before the round of preferred equity financing?

- How did the converted notes get factored into a fully diluted number to then calculate the preferred share price?

- How did an option refresh work into this?

- Should I use a pre-money or post-money number to drive all of my numbers – or use both?

- What did my post-financing or post-money cap table look like?

- What if I sold my company after the financing – who would get what, and how would that work?

Solving This Problem for Myself as an Angel Investor and Venture Lawyer by Building a Model

So with some incredible help from, Ivan Ivankovich and John Cobb at Fullstack, we built a model that resolved each of these questions and did not break. We used this model for my angel investments and internally at my law firm, O&A, P.C. We also open-sourced an earlier version of this model that folks at Science Inc., Carta, and Captable.io all downloaded. Over time, we noticed that versions of our old model came back to us on the other side of a number of venture deals. Also, some of the features in the model started to appear in Captable.io or Carta. Along the way, we updated our model to handle post-money SAFEs and the hardwired chunk of equity that places such as Y Combinator and some other notable accelerators will require with a SAFE or convertible note. Today, we use our model with all of our startups, even if they are using Carta or Captable.io.

Why the Model that Works for Me Will Also Help You in Today’s World of Captable.io, Carta, and Pulley

In today’s world with Carta, Captable.io, and Pulley, why do you need the less-flashy SUP Excel file Cap Table? Here are just some of the reasons:

- Detailed and purpose-build – our dynamic Cap Table was built by a team that supports both companies and investors. The Cap Table enables you, the founder, to model out your current capitalization (including stock incentive plan), current and potential SAFEs or convertible notes, your potential Series Seed/A preferred equity financing round, and then the exit or waterfall proceeds to all shareholder groups. Investors can see what percentage of the company their investment is buying, whether via a SAFE, convertible note, or purchase of preferred stock.

- Price – For $50, you can download our dynamic Cap Table. Carta, who we partner with as they provide a number of services beyond just cap table management, would cost you thousands or potentially tens of thousands. Similarly, Captable.io would require you to buy its premium product, which is priced similarly to Carta. Although these companies provide many functions that may be useful to you, such as allowing for the exercise of stock options and performing 409A valuation reports, the cost can be prohibitive for early stage companies, and their outputs are less intuitive than those on the SUP Cap Table.

- Battle-tested accuracy – You can have peace of mind that our Cap Table model works! It was built by venture financing people (Fullstack and an angel investor who has invested in Oculus and Clutter) and venture lawyers at O&A, and it has been used for tons of venture financing transactions over the past 5+ years.

- Interactive manual – Our how-to manual and video explain how to use the Cap Table, as well as the concepts and economics underlying the formulas in the Cap Table.

- Real people to answer your questions – Unlike Carta or CapTable.io, if you want help with the SUP Cap Table, you can get it from the people who built it and work with it every day. Ping us, sign up as a client, send us your questions, and we can schedule a one-on-one over Zoom or answer your questions in writing.

So, for $50 vs. monthly recurring fees, you get a powerful Cap Table that you can use again and again, with no subscription fee. If you need some help, there’s an interactive manual that you can also purchase. If you need consulting, you can talk to the people who actually use the SUP Cap Table every day to monitor the debt and equity for various financings and startups. Nothing better than having the tool (Cap Table), the manual (educational videos), and the specialist (O&A attorneys) all in one place! And when your company has grown and wants to take advantage of the features offered by Carta and CapTable.io, the SUP Cap Table model makes onboarding in those platforms much easier than if you were trying to track down all the loose paperwork and deal terms.