With little cash coming in the door and debt accumulating, startups do not have the means to pay big salaries to attract top tier talent and add to their headcount. That is why startups should consider adopting a stock incentive plan to compensate and motivate employees, contractors, and advisers with stock instead of salaries. Although it may mean “working for free” for now, talented employees will be enticed by the idea of owning a piece of the startup because it could mean a big pay off later when, and if, the startup has a successful initial public offering or is acquired. Although the employee, contractor, or adviser may feel like they are “working for free,” the IRS disagrees.

Most people are relatively familiar with the idea that when they get paid cash for their work (such as payment of wages and salaries), they receive ordinary income that is taxable. On the other hand, most people are relatively unfamiliar with the idea that when you are granted stock as compensation for your work, the IRS treats the grant as the payment of income that is a taxable event like when they are paid cash. And unlike the payment of wages or your salary, there are a multitude of ways in how the stock grant will be taxed that is entirely dependent upon the form and method in which the stock is granted.

When a company grants stock to a founder, employee, consultant, or adviser, the one thing that is certain is that that taxman cometh, so whether you are a member of the board approving stock or a grantee, here is what you should know ahead of time about the tax treatment stock grants.

Taxation of Restricted Stock Grants

A restricted stock grant can mean any of the following:

- You have been granted a right to purchase stock of the company pursuant to a restricted stock purchase agreement (RSPA)

- The company is giving you shares pursuant to restricted stock grant agreement (RSGA)

- You have been granted a restricted stock unit and when that unit vests, you will be issued stock in the company (this article will not discuss the tax consequences of an RSU because it is not common for a startup to make these grants unless an IPO is imminent).

The main difference between an RSPA and an RSGA is that the grantee of a RSPA pays cash for the shares, whereas the grantee of RSGA pays no cash for the shares. The grant of restricted stock has several tax implications worth considering.

The first is whether the grant of the restricted stock is a taxable event. Internal Revenue Code Section 83 governs what happens when someone receives stock in exchange for their services. IRC Section 83(a) generally states that when a person receives stock as payment for their services, they recognize ordinary income equal to the difference of the fair market value (FMV) and the amount they paid for the shares.

Here are two examples:

- Grantee A is granted a RSPA to purchase shares that have a FMV of $200 and pays $100 for those shares. Grantee A has $100 of income to report to the IRS on the date Grantee A purchases the shares, which is the difference of the FMV and the price paid by Grantee A ($200 minus $100).

- Grantee B is granted a RSGA and the company issues shares that have a fair market value of $200. As you may have guessed, Grantee B has $200 worth of income to report, which is the value of the difference of the FMV and the price paid by Grantee ($200 minus $0).

As you can see, if the grantee paid a purchase price for the shares equal to FMV, there would be no taxable event for the grantee on the date of purchase. If the grantee paid below FMV or nothing for the shares, the Grantee would recognize ordinary income on the date the grantee purchased or was issued the shares. When we say “ordinary income” we mean the FMV is treated as if you were paid cash for your wages or salary, so you would be required to both withhold for employment taxes (as you would for the payment of your wages or salary) and you would have to report the FMV as part of your regular income on your IRS Form 1040.

The second tax implication of restricted stock grants is the taxation subject to vesting (i.e. the shares are subject to a repurchase right in favor of the company in the event the grantee stops performing services). If your ownership of shares is subject vesting, it will change when the grantee would recognize income.

What was not mentioned above about IRC Section 83(a) is that the grantee recognizes income on the date that shares are no longer subject to “substantial forfeiture,” which means, for our purposes, the date when the shares are vested and are no longer subject to being repurchased by the company. That means the date when the shares vest is both the date when income is recognized and the date used to determine the FMV. Here is an example:

Grantee C is granted a RSPA to purchase shares with a FMV of $200 and pays $100 for the shares on Jan. 1, 2021. Grantee C’s shares will vest after she has completed one year with the company. On Jan.1, 2022, Grantee completes one year with the company, the shares have vested, and those shares now have a FMV of $300. That means on Jan. 1, 2021, Grantee C has no income to report to the IRS, but on Jan. 1, 2022, the Grantee has $200 of income to report ($300 minus $100).

Grantee C would have been way happier if she recognized income on Jan. 1, 2021, instead of Jan. 1, 2022 ($100 vs. $200). The good news is that IRC Section 83(b) provides Grantee C a right to elect to recognize income on the date of purchase/grant of the shares by filing an 83(b) Election with the IRS. An 83(b) Election is an immensely useful tool for startup founders and advisers, who often purchase shares for negligible amounts because the FMV of the shares of a pre-product and pre-revenue startup is almost certainly insignificant, like $0.00001 per share.

The last event a grantee should be concerned with that gives rise to a taxable event is the sale of their shares, but we are not going to cover that here.

Taxation of Stock Options

As you may already know, a stock option is a contractual right to purchase shares at a fixed price (the “exercise price”) for a period of time. There are two types of stock options: non-statutory stock options (NSOs) and incentive stock options (ISOs).

Taxation of NSOs

Generally, an NSO does create a taxable event for the grantee on the date of grant or when the NSO vests if it was designed to comply with IRC Section 409a. There are multiple requirements to comply with IRC Section 409a, and most stock incentive plans are designed to comply with 409a (the plan that StartupProgram.com provides is). The one requirement of 409a that is most likely to be violated is that the exercise price of the NSO be at least equal to the FMV on the date of the grant of the NSO; otherwise, the NSO grantee will recognize ordinary income when the NSO vests (even if it is not exercised) equal to the difference of the FMV on the vesting date and the exercise price, and be assessed a tax penalty equal 20% of the ordinary income recognized. The easiest way for a private company to avoid this outcome is for the company to get a 409a report as required under the safe harbor provisions of 409a.

A grantee of a NSO does recognize ordinary income on the date the grantee exercises the NSO, which is equal to the difference of the FMV on the date of exercise and the exercise price (per IRC Section 83), and again when the grantee sells the stock. If the NSO can be exercised early, everything we discussed above regarding taxation of a restricted stock grant under IRC Section 83 will apply. Since the grantee will recognize ordinary income on the date of exercise, the requirements for withholding and reporting the grant as income are applicable in the tax year the stock option is exercised.

NSOs can be granted to directors, employees, contractors, and advisers.

Taxation of ISOs

ISO stock options can be granted only to employees and carry a more favorable tax treatment compared to NSOs.

ISOs are not taxable to the grantee on the date grant, upon vesting, or upon exercise by the grantee, unless the alternative minimum tax rules apply, if the stock incentive plan authorizing the grant of ISOs and the ISO meet the strict statutory requirement of IRC Section 422. Similar to NSOs, the requirement most likely to be violated is that the exercise price of the ISO does not equal the FMV of the stock on the date of grant; this is another reason why a 409a appraisal report is so important for a startup to get.

Essentially, a grantee who exercises an ISO will recognize only long-term capital gains so long as the grantee holds the stock for at least a year from the exercise date before selling the stock. If the grantee sells the stock purchased pursuant to the ISO within the year, the ISO will be treated as a NSO. As you may have noticed, a grantee of an ISO may never recognize ordinary income as a result of the grant or exercise of the ISO, which is why it is tax-advantaged.

Note: there are additional requirements under IRC Section 422 that have been omitted from this discussion that we recommend you speak with an attorney about.

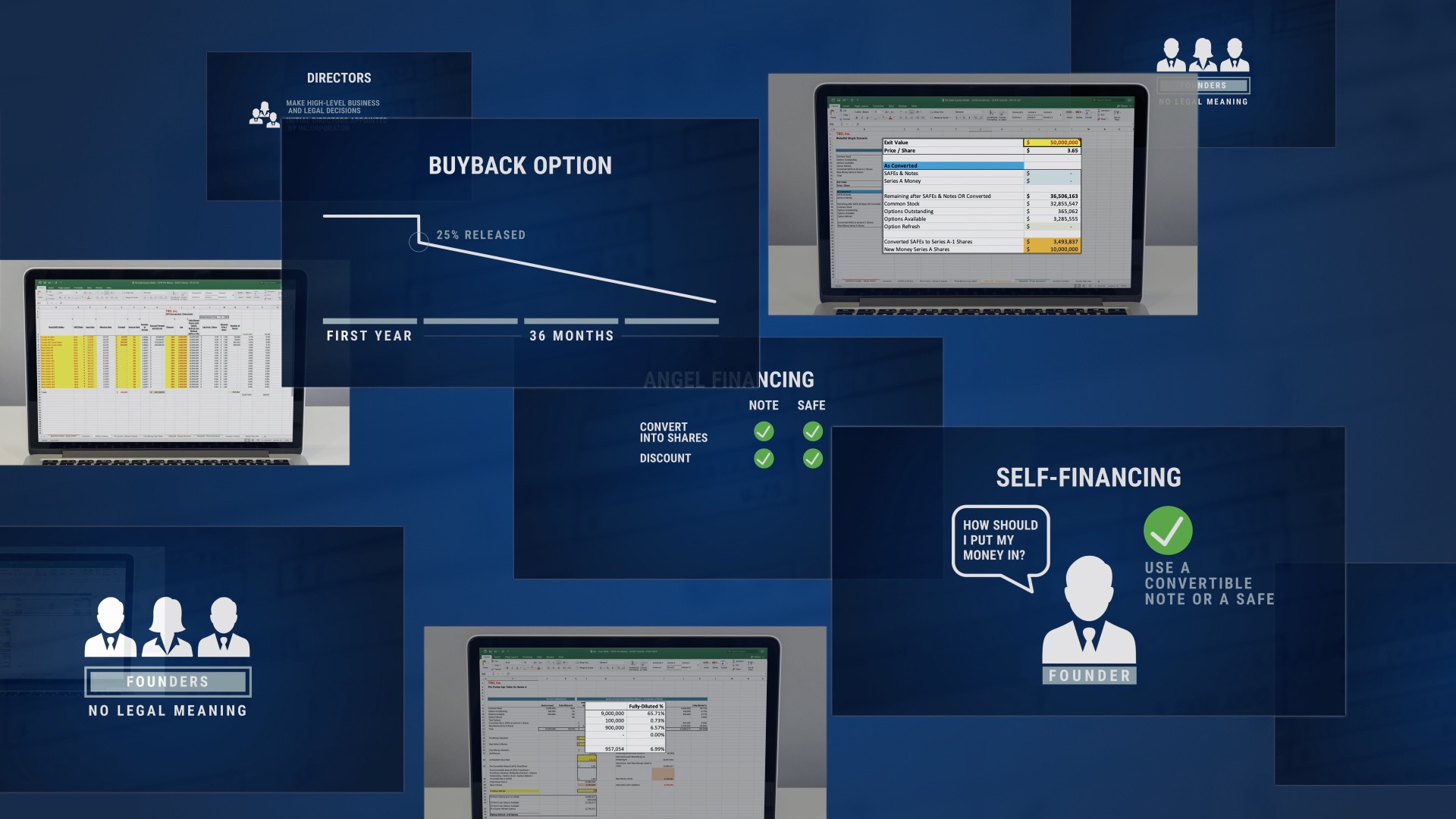

How to Set Up and Manage Stock Incentive Plans

StartupProgram.com Academy, closely integrated with our SUP cap tables, can guide you through all the steps in setting up a stock incentive plan for your startup. Our video lectures discuss allocating shares for a plan, vesting schedules, buyback agreements, tax considerations, and much more.

And for extra peace of mind, StartupProgram.com Professional Services can help you with all the filings you’ll need to set up your stock plan (as well as everything else you need to form a new corporation designed for the pursuit of venture capital). And with our partner company O&A, P.C., we’ll review your cap table and incorporation plans to ensure you’re ready to launch your startup with a safe, venture-ready foundation.