Startups usually begin with a small group of founders, and they may not hire employees for months or even years after forming. So you might think a stock incentive plan — usually considered a motivational tool for employees — is something a startup can wait to set up until the venture is ready to hire.

In reality, a stock incentive plan is a powerful tool founders can use to incentivize employees, advisors and contractors, so a startup should adopt a stock incentive plan as soon as it is formed.

What is a Stock Incentive Plan?

Cash-poor startups with no revenue don’t have the means to pay employees attractive salaries, but they can make up for the lack of cash by paying for services with its shares. You will be surprised by how many people are willing to work for equity because of the allure of the prospect of a big payoff down the road when the startup sells or goes public.

A stock incentive plan, or stock option plan, creates a method to dole out shares as compensation as soon as the advisor, employee, or contractor starts providing services. Also, you can keep these persons engaged with time-based vesting, so the longer the employee stays with the startup, the more shares he or she will own. Hopefully, the company wins angel and venture capital investment, becomes a great success, and exits via an IPO or acquisition — creating a huge windfall for the employee as the shares granted from the stock incentive plan skyrocket in value.

4 Reasons To Create a Stock Incentive Plan When You Form Your Company

Founders of young companies may not yet have employees to grant stocks, but setting up the stock incentive plan when a venture is first formed is ideal for a number of reasons:

Locks Your Cap Table: By adopting the stock incentive plan on formation, the founders will know exactly what percentage of the company can be offered to advisors, employees, and contractors. That is what we call locking your cap table. It also makes negotiating with advisors, employees, and contractors much easier because you know exactly how each grant affects your cap table.

Efficiency: Adopting a stock incentive plan at the outset saves you a ton of costs and headache that are associated with complying with securities laws. The reason for this is that every time a startup grants or sells stock to someone, it needs to comply with securities laws. Every sale and offer of stock must be registered with the SEC or state authorities unless the sale of the stock is exempt from registration. Most exemptions from securities registrations at the federal and state level require a notice filing for each stock sale, which also requires paying legal fees and filing fees. The SEC and most state laws provide an exemption from registration sales from stock plans that are properly adopted by corporation, which means that once the plan is adopted, every future sale of stock out of the plan is exempt from registration, even if the price of the stock goes up (note, there are limits to the total value of stock that can be sold from a plan in a single year, but no pre-revenue startup will ever hit those limits). For the states that do require a notice filing for a stock incentive plan, once you make the filing, there are no additional legal fees and filing fees for each new sale after you make your first filing. Other exemptions from registration may require you to make a filing for every sale.

Additionally, the other great efficiency of stock incentive plans is that grantees only need to provide services to the corporation to comply with the exemption and the corporation does not have to comply with the more rigorous accredited-investor qualifications (or its state equivalent) that every other securities exemption would require.

Currency: A stock incentive plan also gives founders, at the beginning, much needed currency to hire talent. When the stock incentive plan is put in place at the outset, founders now can lure talent who want to be able to say, “I made millions from my stock as one of the first employees of XYZ Startup.”

Early in a startup’s life, the company is valued at next to nothing, and the stock price reflects that. The price per share may be something like $.00001; at that price, one could buy 1 million shares for $10. Imagine you had 50,000 shares of Facebook right now and you paid $0.05 for it; you would have millions of dollars and be more than satisfied with your return. That’s the American startup dream!

When founders implement the stock incentive plan at the start, they have available low-priced stock that can be used to grant stock options to key contractors, advisors, and employees. Stock that is priced low at the start can be a huge incentive to get top talent onto a startup’s team.

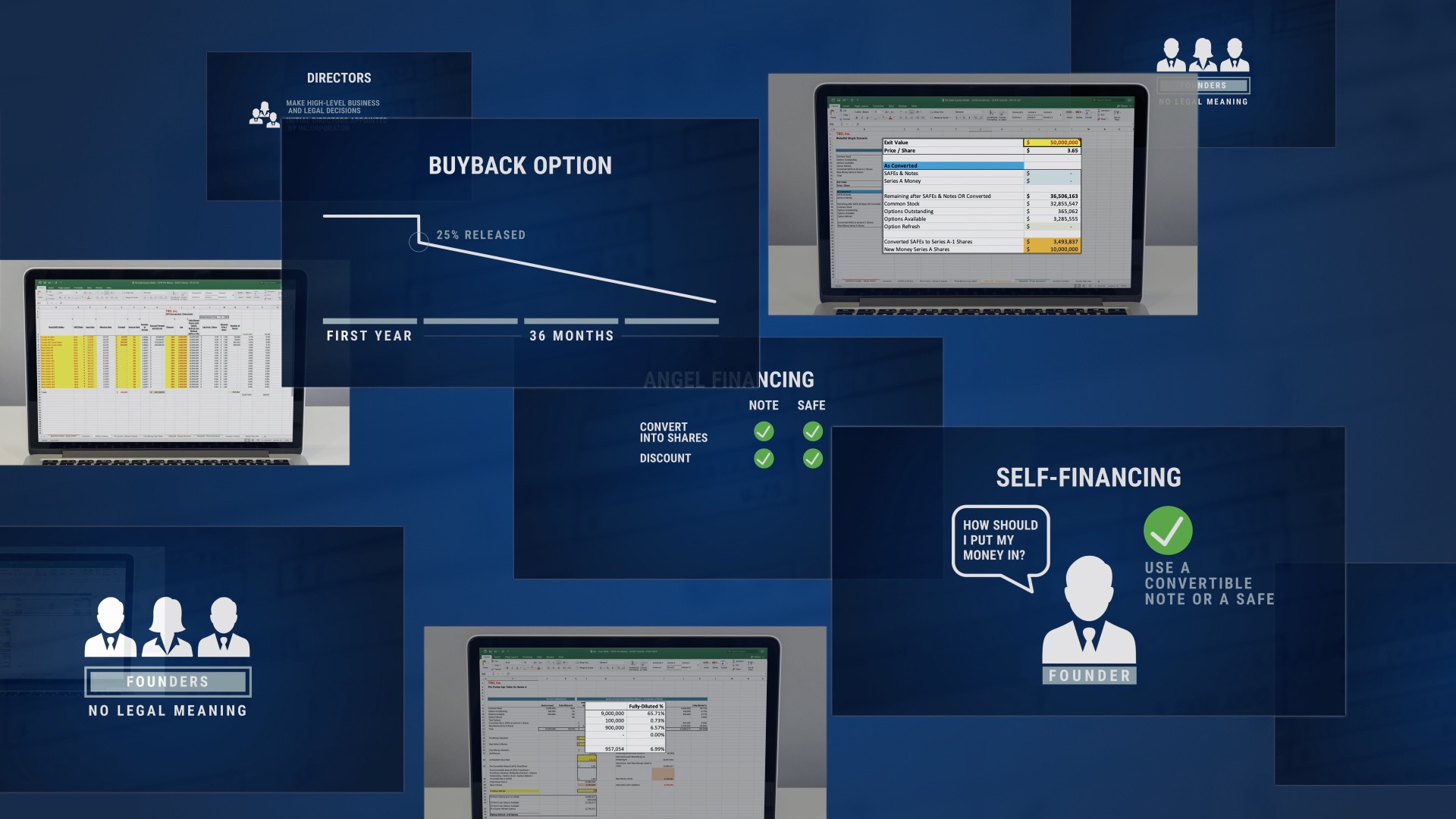

Retention: While a stock incentive plan’s creation of currency brings in talent, you can keep talent for the long haul with vesting built into each stock grant. Vesting is a schedule spelling out when the employee owns their shares (in the case of a restricted stock purchase) he or she has been granted without fear that the corporation will buy them back pursuant to the corporation’s buy back right — this is what we call reverse vesting. In the case of stock options, vesting refers to the when an option grantee can elect to purchase shares. In either case, employees who participate in a stock option plan will want to stick around to see their shares vest in order to hold on to the potentially lucrative equity.

How to Use a Stock Incentive Plan

A company’s board of directors must approve any stock grants in a resolution – the CEO, president, and other officers cannot approve stock grants unilaterally. There are a number of ways stock can be granted from a stock incentive plan, each with different tax and legal implications:

Incentive Stock Options. ISOs can be used only for employees and have annual limits, but carry a beneficial tax treatment compared to non-qualified stock options.

Non-Qualified Stock Options. NSOs can be granted to contractors or employees and have no annual limits, but the option holder pays more in taxes.

Restricted Stock Grants and Purchases. Restricted stock follows the same principles as stock purchase agreements used with company founders. The main difference between a Restricted Stock Grant Agreement (RSGA) and a Restricted Stock Purchase Agreement (RSPA) is that when issued to an employee, no payment is required for an RSGA, where an RSPA requires the employee to pay the fair market value of the stock being offered.

If the shares in any transaction are subject to a company repurchase option (as is the case when reverse vesting is used), the grantee must be sure to file a specific election with the IRS to avoid a big tax bill with no income to pay it.

How Shares in a Stock Incentive Plan Are Priced

A company’s board of directors has to determine the fair market value of the common stock when the board reserves the common stock for the stock incentive plan. At formation, a company’s stock in the plan arguably can have the same low price as founders’ stock, because the company has no real book value.

After a “material event” — for example, a round of financing — the board of directors is required to determine the fair market value of the common stock price, and an independent firm performs what’s called a 409(a) appraisal to consider the recent events that may have changed the price.

The typical first material event is a preferred equity financing round. As soon as a third-party investor provides a term sheet for an arm’s length transaction, which includes a valuation of the company or its common stock, the price of the stock in the stock incentive plan is no longer current, and a company needs to complete the 409(a) appraisal before granting or selling any more stock from the stock incentive plan.

Learn More About Stock Incentive Plans And Build One Into Your Cap Table With StartupProgram.com

StartupProgram.com Academy, our exclusive online lecture series for startup founders who plan to seek venture capital, features a lecture dedicated to stock incentive plans (as well as a wealth of other knowledge founders need to be successful). We’ll walk you through setting up a plan, the important tax considerations, how reverse vesting works, and more.

Tightly integrated with the lectures is our Debt Equity Model cap table, which will help you draw up your stock incentive plan, track grants from the plan, and understand the economics of the shares in your plan. Our cap tables are included with your enrollment in StartupProgram.com Academy, and they can also be purchased separately.