You just received a term sheet for a round of preferred equity financing in your company – how exciting! But what do the terms mean, and which ones should you really care about? Your company’s initial rounds of financing set the precedent for future raises, so it is important for you, as the founder, to know what you are agreeing to with an investor.

Because it can be overwhelming when presented with a term sheet full of unfamiliar terms, we have prepared this walkthrough of some key terms that entrepreneurs negotiate with venture capital firms on a term sheet, and their implications on the company moving forward.

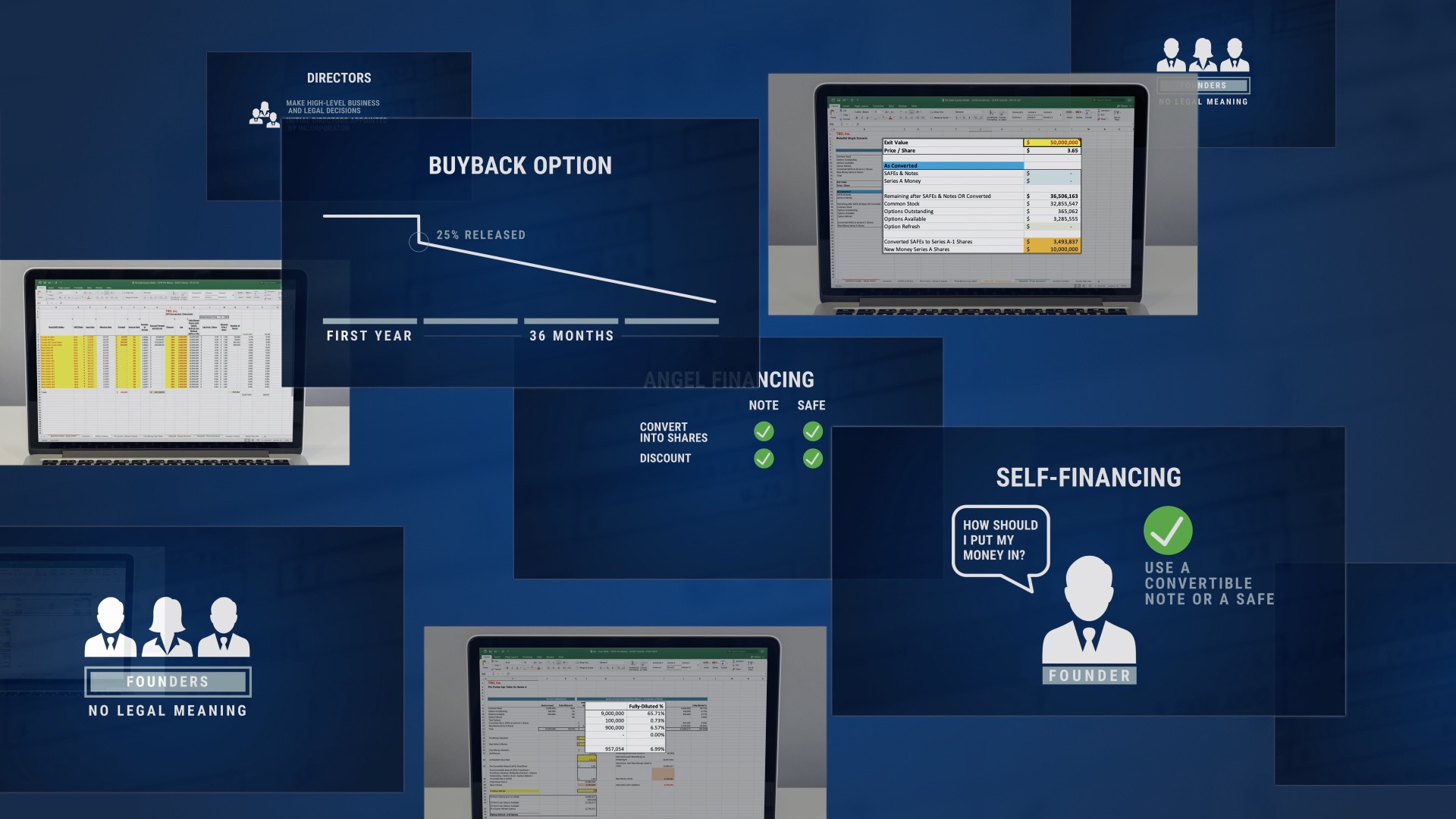

Valuation

The pre-money valuation is the value of your company’s fully diluted capitalization immediately prior to the investment, which will include the option pool and may include an option refresh if requested by the preferred investor. Although more of a business term than legal, the pre-money valuation drives both the percentage of the company that the preferred investors are receiving in exchange for the money being put in and the conversion mechanism used by any convertible instruments that will be converted into preferred stock during the financing. This is key as the percentage the investors receive becomes important when it comes to founder dilution, voting control and capitalization of the company, especially if the preferred investors also receive a board seat in connection with the financing. However, a higher valuation may not always be better, so it is important to consider the impact the terms will have on the business as a whole in addition to the general context of the situation and whether the investor will be the right partner for the company when negotiating the pre-money valuation.

Board Rights

The make up of the company’s board of directors is an important negotiation point as the board is required to make key decisions and oversee the management of the company. The consideration here is whether the preferred investors will have a board seat, a board observer role, or no board rights at all in addition to their rights and privileges as preferred stockholders. Because control over the board affects the governance of the company and as well as critical matters of the company, such as appointing and replacing officers, you should try to keep the majority of the board in the founders’ hands, and with an odd number of board members to avoid a deadlock. There can be any number of variations on the board’s composition, including independent director seats, and if you have more than two founders on the board, some of them may be asked to step down to make room for the preferred directors. If you agree to give the preferred investors one or more directors, keep in mind that you will be giving up an additional layer of control that may include express veto rights for the preferred directors over certain decisions. Always have open discussions with your potential investors about the board and governance so that everyone is on the same page.

Liquidation

A liquidation preference sets forth the return an investor receives in a liquidating event (such as a sale of the company) and provides the preferred investors the opportunity to be paid before common stockholders upon an exit based on the amount of money the investor has put in. This is one of the ways that investors get “downside protection” if the company does not achieve the big exit the investors were hoping for, and it directly impacts a common stockholders’ right to receive proceeds in a sale of the company.

However, how much and when they receive the payment depends on the type of liquidation preference the preferred investors negotiated. Generally, the investors’ liquidation preference starts at 1x, meaning that they would receive their initial investment back. So, if the proceeds from the exit are less than what preferred investors are entitled to through their liquidation preference, all of the proceeds would go to the preferred investors – and the common stockholders would not receive anything. If the liquidation preference is based on a different multiple, i.e., 2x or 3x, it means that the preferred investors get two or three times their initial investment before the common stockholders receive exit proceeds. Aside from the liquidation preference multiple, the other important mechanism is whether the preferred investors have participation rights. These rights allow investors to “participate” with common stockholders in the distribution of proceeds – after already receiving their liquidation preference, which will further dilute the common stockholders’ right to proceeds. Be wary of term sheets that include participating liquidation preference or a multiple higher than 1x. And keep in mind that the liquidation terms that get put in place in your first priced round often get carried on to later rounds as the starting point of negotiation.

Founder Vesting

Generally, because the venture capital investors are coming in as “partners” with the company (but specifically with the founders and certain key employees), they want to make sure that the founders and key employees stay to scale and grow the company until an exit. As a result, VCs will ask for “revesting,” where a founder’s or key employee’s shares (regardless whether they have fully vested or substantially vested) become subject to vesting again to further this goal – generally four year monthly vesting, with a one year cliff. A key negotiation will be whether the investors ask you to revest your shares from the date of the financing or whether you are given credit for time served.

Preferred Stock Protective Provisions

It is common that the preferred investors will have a set of veto rights or “protective provisions” in connection with the company’s corporate actions. This provision outlines certain scenarios that will require the consent of a threshold of the preferred holders (generally a majority voting as a separate class), which sometimes may be mitigated if the company negotiates that certain actions will require the consent of only the preferred director in lieu of the preferred stockholders. The protective provisions are heavily negotiated and are important as they allow the preferred stockholders to have control over business decisions in certain cases. Common protective provisions preferred investors will negotiate for include approval rights before:

- Liquidating or dissolving the business

- Amending the company’s charter or other governing documents

- Authorizing or issuing shares unless they rank junior in rights, privileges, and preferences to the shares issued in the financing

- Taking distributions on capital stock

- Creating or amending a stock incentive plan

- Issuing or entering into debt above a certain amount

- Creating or holding stock in a non-wholly owned subsidiary

- Increasing or decreasing the number of directors and/or number of votes a directors has, among other things.

You should always evaluate these provisions carefully because with the preferred investors, you now have a new partner in the business, whose buy-in and agreement is needed before you can bring in more capital or really change the legal and governance structures of the company. In other words, with the new protective provisions in place after a round of financing, controlling the common stock – or 51% of the company – is no longer enough for you to make material corporate decisions as you will also need to solicit the approval of the preferred voting majority.

Anti-Dilution

Finally, the preferred investors will almost always ask for anti-dilution protection, which comes into play when the company does a down round financing, and impacts the conversion price and therefore the conversion ratio of preferred stock to common stock. “Broad-based weighted average” and “full ratchet” are two methods of calculating the adjustment to the conversion ratio. While a broad-based weighted average adjustment uses a formula that takes into account the number of shares issued in the down round and the price of those shares, among other things, to determine the conversion ratio adjustment, the full ratchet adjustment lowers the conversion price to match the price per share of the preferred stock issued during the down round, which effectively re-prices the existing preferred stock to the down round price. Do not accept “full ratchet” anti-dilution protection without talking to your advisors about the impact on the business and existing common stockholders (including the founders).

Conclusion

Although this is just a summary of some of the key terms you may negotiate on your preferred equity term sheet, we hope the above explanations give you, the entrepreneur, a sense of confidence and understanding as you head into negotiations with the experienced venture capitalists. O&A, P.C., is experienced counsel to both companies and investors, and is more than happy to assist you through your fundraising efforts.

ABOUT O&A

O&A is an elite team of attorneys led by Managing Partner Dan Offner and committed to helping clients achieve their objectives — efficiently and effectively. The firm represents some of the biggest companies in technology and interactive entertainment, as well as some of the world’s most innovative entrepreneurs and emerging growth companies. For more information, please visit https://oandapc.com.

O&A’s StartupProgram.com (SUP) is designed to support entrepreneurial startups, offering complete company formation services delivered through an efficient platform coupled with an exclusive e-learning curriculum designed for founders. SUP gets startups up and running at a much lower cost than working with a big law firm – and without the risks of using do-it-yourself legal alternative websites. Visit SUP to learn more or book a demo of the service today.