Now that you’ve formed your business and you and your fellow founders are hard at work building your startup, if you are like most burgeoning businesses, at some point you will need an injection of cash to keep the lights on and the engine running. But as founders of an early stage private company, you often have limited cash resources at your disposal. As such, your first foray into raising outside capital needs to be efficient and cost-effective.

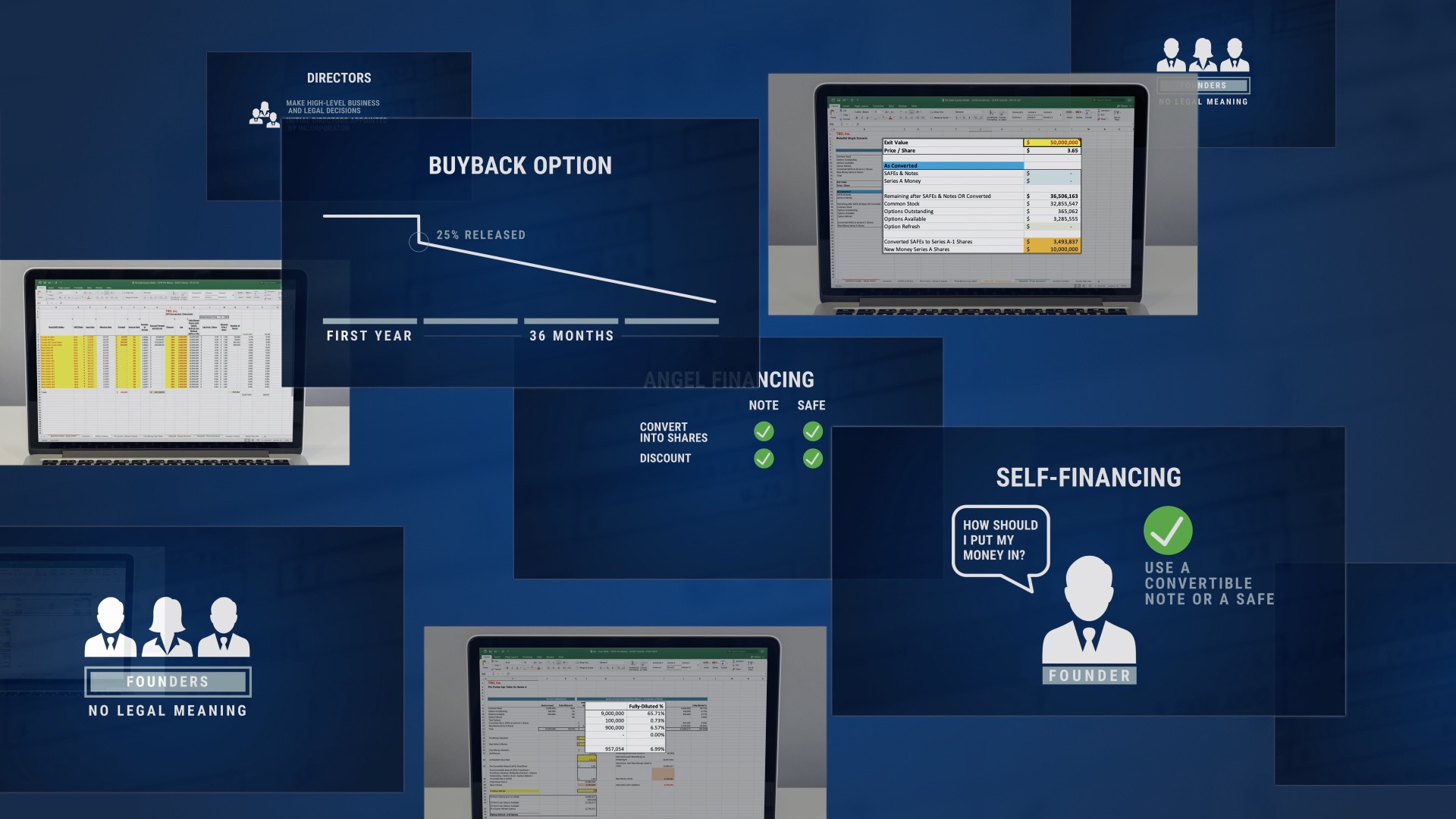

At this juncture, it’s important for you, and your potential investors, to understand your cap table. This is because whenever you bring in investors, your cap table will change, but the degree to which it changes may depend on the terms you negotiate with those investors.

Venture Financing Basics, Key Investment Terms

Part of the negotiation between a company and potential venture investors in a Series Seed or Series A round of financing involves establishing the company’s pre-money valuation, or what the company is deemed to be worth prior to the venture financing, which is a round of financing that prices the company’s stock. The pre-money valuation together with the amount of new money invested through the venture round results in the company’s post-money valuation. Establishing these amounts allows you to calculate the price per share for the new money investment, which is the pre-money valuation divided by the number of pre-money shares. Dividing the amount of the new investment by that price per share is how we calculate the number of shares of preferred stock purchased through the round by the new money investors.

While the process and key terms of a venture round as detailed above are generally standardized, a formal venture round is still time consuming and can be prohibitively expensive for younger companies. Further, a venture round sets the valuation of the company, which, if done too early, has negative consequences down the line, affecting potential future financings.

A more efficient and cost-effective alternative to raising funds through a venture round is through the use of convertible instruments, such as a simple agreement for future equity (a “SAFE”) or a convertible note (any reference to SAFE or SAFE investor hereinafter will include convertible note and convertible note investor, respectively). However, just like in a venture round, there are various nuanced concepts at play that a founder must be familiar with in order to raise sufficient capital without forfeiting too much equity in the process. One of the most important of these concepts is the valuation cap (sometimes referred to as just the cap). In the simplest terms, a cap is the maximum valuation at which the SAFE will convert into equity.

The cap amount is negotiated and agreed upon by the company and investor, and can have a profound effect on the dilution of the founder’s equity after subsequent financings. Including a cap in a SAFE is typically more investor-favorable, but this is sometimes a fair tradeoff in order to receive investment at an earlier stage in the company’s lifecycle. The way this works is, as long as the valuation cap in the SAFE is lower than the pre-money valuation in the venture round in which the SAFE will convert into preferred stock, the price per share for the SAFE investor’s converted shares will be less than the price per share for the preferred stock purchased by investors in the venture round, i.e. the SAFE investor will receive more shares per dollar than investors in the venture round. This results in a larger piece of the pie for the SAFE investors than had they invested the same amount in the later venture round. From an investor’s perspective, a cap serves as an added incentive for taking the risk of investing early on in the company’s lifecycle, entitling the investor to getting a bigger bang for their buck.

An example of how a cap works

Let’s demonstrate how the cap will apply in a subsequent round of venture financing, which triggers the conversion of a SAFE into shares. As a basic example, say an investor invests $1 million into the company on a SAFE which includes a $10 million valuation cap. Assume the only equity in the company up to this point consists of 10 million shares of common shares, held by two founders. Later on, after the company matures and is in need of venture capital, it raises a Series Seed investment of $3 million at a pre-money valuation of $15 million. If the SAFEs didn’t include the $10 million cap, the SAFE would convert at $1.50 per share ($15 million pre-money valuation / 10 million shares outstanding). However, the cap of $10 million means the SAFE investor will convert into equity at $1.00 per share ($10 million valuation cap / 10 million shares outstanding). Thus, with the cap, the SAFE investor is entitled to 1 million shares in the company (assuming no interest), whereas without the cap they would get only 666,667 shares.

As you can see, there is significant upside for the investor when there is a valuation cap. Since valuation caps are common, it is important for the company to understand and negotiate an appropriate limit. Setting the cap too low can result in a significant amount of dilution in the company, whereas a high valuation cap may cause your Company to be overlooked by potential investors. When negotiating for a valuation cap, it is important to look at the current industry of the company, the amount of leverage the company has, and the current fundraising market. These factors will allow the company and the potential investor to get to an agreeable place.

The corporate attorneys at O&A handle various financing matters for clients daily. Please contact us to discuss your financing needs.