You need others to help build your business, but as you build your team, it is important to distinguish the different roles in your corporate structure. Are you dealing with co-founders with whom you started the company? How do you divide up the equity? Do you have a board of directors, and if so, who is on it? Did the board appoint any officers? Do you need to hire employees, advisors, or contractors to help carry out the company’s objectives? Answering questions such as these is essential to running an efficient and successful corporation.

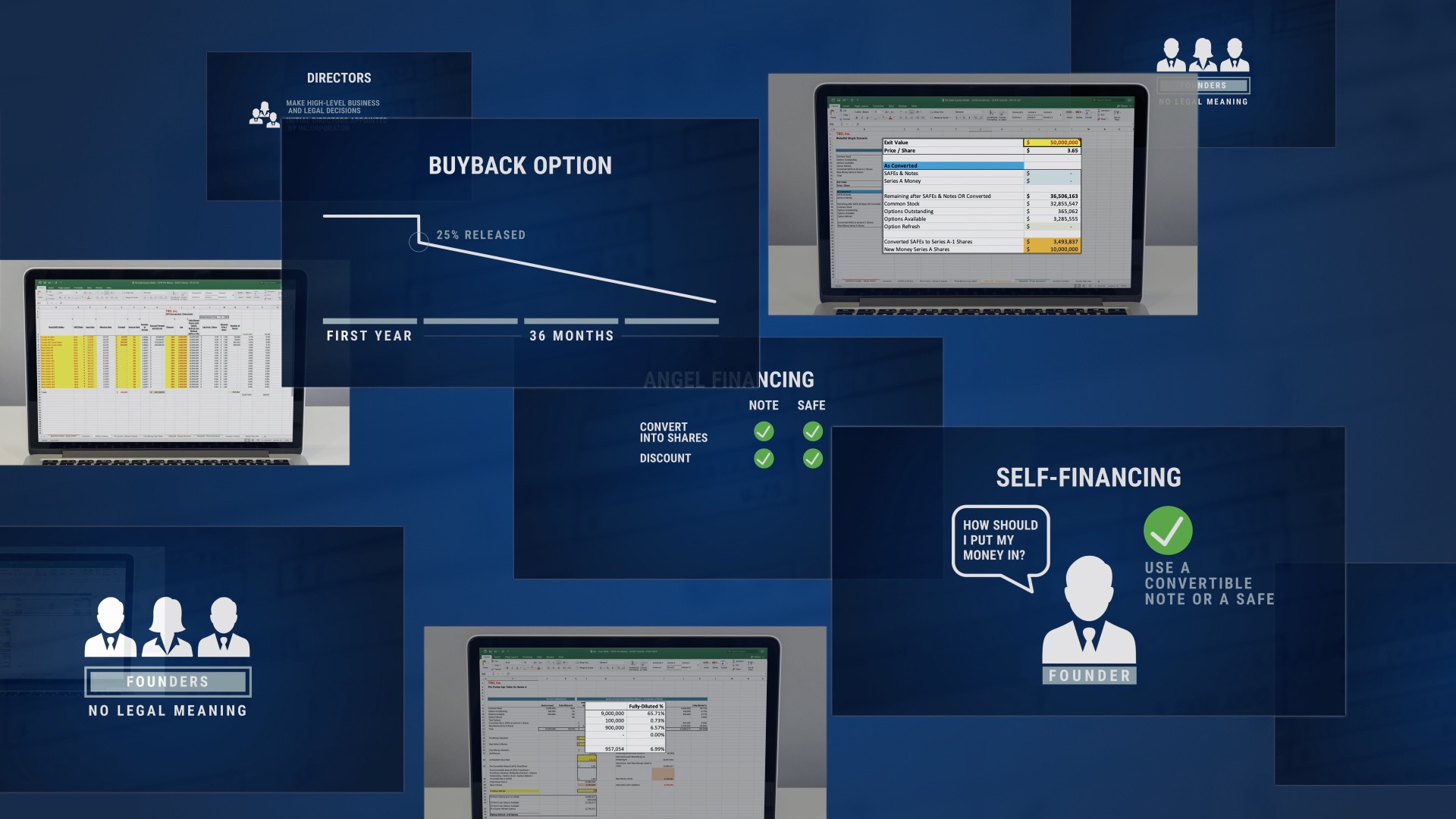

Founders

Founders are typically behind the beginning of every startup; they are the persons who establish the entity. After deciding to start the company, the founder or more likely, the founders, will need to secure funding, bring in resources, and begin creating or coding the product.

Despite the term “founder” being one of the most important titles in the business of entrepreneurship, having the title of founder does not, by itself, carry any legal significance – it’s a business concept. Having the title of founder does not by itself grant you any equity or stock ownership, nor does it mean you automatically have the right to make decisions on behalf of the corporation. It is more of a statement of fact, that you alone or in a group, had the idea for the company. Thus, unlike other employees who lose their titles when they leave the company, if you helped to start a company, you will always be a founder, even after you leave.

Founders often are with the company in some employment capacity; for example, as the company’s president, CTO, or Head of Business Development. He or she should receive an offer letter that sets forth their compensation, which can consist of a salary as well as equity, and also indicates what the founder’s role in the corporation will be. Founders also sign a Confidentiality and Invention Assignment Agreement (“CIAA”), in which they agree to protect and safeguard the corporation’s confidential information and intellectual property, agree not to enter into any agreements that conflict with the company or engage in activities that compete with the company, and agree to work for hire provisions which assign the company any proprietary material or inventions created during employment with the company or that is material to the company’s goods or services.

Directors

Every corporation needs a board of directors (“the board”), which is elected by the corporation’s stockholders to oversee the general governance and direction of a corporation on behalf of the stockholders, the owners of the company. It is the governing body for the corporation with a specified number of seats that makes major decisions such as authorizing capital stock, hiring and firing officers, and setting the salaries, compensation, and benefits of the company’s officers. The board makes these decisions by voting, either by holding a meeting in person or through written consent that at a minimum requires majority approval of the board.

The board and its members are sometimes designated in the articles of incorporation, which is filed with the secretary of state of the state in which the company is formed. If the articles fail to name the initial directors, the incorporator (the entity or individual who files the articles to register the company with the secretary of state) may designate the initial board. The board of directors is typically small at the formation stage, especially if there is only a single founder behind the company, in which case, the founder will often be the only member of the board. The size of the board is generally established in the corporation’s bylaws. Since most decisions require a majority vote, it is advisable that there be an odd number of board members so that the company avoids a deadlock decision.

Directors on a board generally fall into three categories. The first is insider board members. This category includes those who are part of or close to the company, such as founders, managers, or friends. Often a board will be made up of founders or other insiders from the company’s conception up until future financing rounds. Directors can be officers, employees, or contractors, but are not required to be.

However, once a startup goes through an equity financing round and issues preferred stock to investors, often venture capitalists or other investors condition their investments upon receiving a board seat, among other things. This leads to the second category of directors, the investor board member. You can negotiate to divide the board so that, for example, the common stockholders get to choose two insider board members, while the preferred stockholders can pick only one investor board member.

Finally, independent board members are typically unaffiliated with the company before becoming directors. Independent directors are often chosen by both the insider and investor directors as a neutral person to be the third or fifth (tiebreaker) vote.

All directors, whether insider, investor, or independent board members, owe a duty of loyalty and care to the company, which is called the fiduciary duty of a director. The fiduciary duty requires directors to act on behalf of the company in its best interest, as well as in a prudent, good faith manner and, among many things, not take business opportunities that are in furtherance of their own personal benefit over the company’s. As your company goes through different stages, your board will likely undergo changes as well. As the saying goes: it is easier to elect a board member than to remove one, so take care at this stage to pick your directors wisely.

Officers

Officers are appointed (and removed) by the board of directors. Officers operate, lead and manage the day-to-day operations of the company. As is typically required by most state corporate laws, startups begin with at least three core officer positions: a president or a chief executive officer (CEO); a treasurer or a chief financial officer (CFO); and a secretary.

A secretary’s responsibilities include planning and executing board meetings and ensuring that the directors have the necessary resources and information to carry out their governance duties on behalf of the shareholders. Unless a company’s bylaws state otherwise, the roles of CEO and president both function as executive leadership for the company, with very similar if not identical responsibilities. Thus, it is often unnecessary to appoint two separate people to be the company’s CEO and president – in fact, doing so may create confusion. The same logic applies to the role of treasurer or CFO, which requires tracking cash flow, financial planning, analyzing the company’s financial strengths and weaknesses, and proposing strategic directions. Keep in mind certain states will require that the positions of president, secretary, and treasurer be specifically appointed, so you may need to note that the president is the CEO and vice versa.

Other roles have recently emerged in corporate structure, such as chief technology officer (CTO) and chief marketing officer (CMO), but they lack precedent in determining specific responsibilities. Thus, if you want to include such positions in your company, it is best for the board to expressly define their duties and the scope of authority in writing.

There is no limit to the number of offices that one person or entity can hold; solo founders often hold all three core officer positions at once. Officers can be added by drafting a board consent; but remember that the corporation must formally create these offices before anyone can assume a new position. Under Delaware law, new corporations require, at a minimum, a president and a secretary. However, different jurisdictions have different requirements, so being aware of the corporate laws of your state of incorporation is vital.

Employees

An employee is someone employed by a corporation who generally earns wages or a salary. Thus, officers are usually employees as well because they work day-to-day executive positions for the corporation and may require compensation. Although directors can be employees if they assume an additional position for compensation, they are not required to be employees.

When a corporation hires employees, it must organize payroll and benefits for each employee and formalize their employment with an offer letter. Employees may also be granted equity through stock options or restricted stock awards. A company will generally establish a stock incentive plan so that the company may grant equity to its employees, advisors and contractors. The stock incentive plan is a way to incentivize the employee to remain for a longer period with the corporation since the shares issued will generally have a vesting schedule where the shares will “release” over a period of time.

Employees, as part of their employment, may have some degree of access to internal, sensitive material; thus, similar to founders, you should have each employee sign a CIAA to ensure proper handling of corporate intellectual property and confidential information. This will ensure that employees, through work for hire and assignment language, transfer ownership of any work they produce for the company while working for the company, as well as any derivative works, to the company. By having employees sign a CIAA, you clearly express who owns what, and protect the corporation’s confidential and proprietary information.

You should also consider whether you want to hire someone as an employee, or whether you would rather have an independent contractor relationship with them. To distinguish the two types, remember that employees are on a company’s payroll and receive wages in exchange for engaging in the exclusive relationship with the company, whereas a contractor is an independent worker (or entity) with autonomy as to how to perform the contracted services, is not exclusive to one company, and is not on the company’s payroll. You need to be very careful about the different tax classifications that apply to either a contractor or employee when hiring or engaging with a contractor, as the penalties for misclassifying an employee as contractors can be severe. In addition to contractors and employees, you can also bring people on board as advisors or consultants, who generally provide business and financial advice in exchange for compensation.

Although beyond the scope of this article, it is critical to exercise care when classifying someone as an employee or a contractor. It is not enough to call someone a contractor and formalize it on paper; the law may not permit it based on the particulars of your relationship, and misclassifications can lead to consequences with your state’s tax and labor laws. For more tips, read our post on hiring.

What Now?

You now know the distinctions between founders, directors, officers, and employees. Hopefully you now have a better idea of who your company needs to get things moving. Enlisting the help of a corporate attorney or a program such as StartupProgram.com can help you further understand the documentation you need to properly engage with the individuals and entities that make up your company.