When you hear “startup,” what comes to mind?

Maybe you think of new high-tech ideas being deployed on apps and companies poised to be the next Facebook, LinkedIn, or Uber. Or maybe you think of startups more along historical lines, with tales of technology giants who started in garages, such as Apple in the 1970s (although that story may be more myth than fact).

What about socks?

Founded in 2009, sock and underwear maker Stance “saw a category that had been ignored, taken for granted, looked over, and dismissed,” as the firm’s website says. Stance, based in Orange County, Calif., has gone on to raise $116 million in venture capital over five funding rounds, including investments from Menlo Ventures and August Capital.

But socks, dating back to ancient Greece, are decidedly low tech. So can we call Stance a startup?

What Exactly Is a Startup?

“Startup” is an informal term, and while it does conjure images of new technology and famous Silicon Valley brands, a company can be a startup and have nothing to do with tech or the Bay Area.

In the very simplest terms, a startup is a young company. Usually, however, “startup” implies a number of other characteristics:

- A startup is usually a small business, with co-founders and maybe a few early employees, advisors and contractors

- Often, a startup hasn’t yet launched a product — in fact, the founders may still be working on their business ideas and figuring out what exactly their product is. In other words, defining their business model.

- And as you might expect from a company with no product, a startup usually doesn’t generate revenue

- And with no revenue and an incomplete product, startups are in search of investors to fund early growth potential, development, and, eventually, marketing. Investors for a new company can include angel investors and venture capitalists.

- From an investor’s point of view, even lean startups are high-risk, but high-return opportunities.

At some point, a company graduates from being considered a startup. Once it has a product in the marketplace and is generating revenue, and certainly when it is making a profit, few would still call a company a “startup.” Facebook, Google, Microsoft and Uber were once startups, but it’d be silly to apply that term to them now.

And that’s the path Stance took, so it’s safe to say it was indeed a startup, despite the company’s product being in a category that’s been around for thousands of years. (Stance has gone on to expand its product line and strike sponsorship deals with dozens of athletes, so we probably should now put them in the category of “startup graduate.”)

Who Works for a Startup?

Considering the high risk nature of startups, those who work for a successful startup generally share a unique set of characteristics:

- Understanding that you are sacrificing job stability with a large company for the opportunity to make real immediate change in your business venture

- Passionate about the company’s business plan and purpose in solving an existing pain point

- Comfortable with working with a small team

- Accepting that your role is dynamic in nature with the need to wear multiple hats

Often looking at the team within the company will be a telling sign of whether it is a startup. A team of three to 10 people who can all speak to the company’s goal is generally an easy tell of early stage company. Now, if that same group is able to speak to the company’s vision to scale and raise money, then you have a company that better fits the character of a startup.

The “Startup” in StartupProgram.com

If we believe that “startup” is a term applied to a broader range of companies than just Silicon Valley tech companies and tech startups (and companies such as Stance make the cut), who else should we include?

Imagine a friend tells you he wants to start a new business: a restaurant in a vacant space on the corner. Your friend is the founder, and has hired only a couple employees so far. He hasn’t put together his final viable product yet (he’s still working on the menu), and because he’s not open for business yet, he has no money and is asking whether you’d like to invest in his endeavor.

Is this a startup?

Although we’d wish your friend luck with his own business, our definition of “startup” at StartupProgram.com would not include his restaurant. At StartupProgram.com (and in most startup-world circles) the term startup includes the idea that the company seeks venture capital investment. Accordingly, we’ve designed services for entrepreneurs who want to launch companies that will be funded by venture capital.

Venture capital is by far the biggest investment engine for startup companies, and adding its role to our definition helps build out the meaning of “startup”:

- Startups seek funding from venture capitalists or venture capital firms

- Startup business owners are willing to cede some ownership and some control of their companies in exchange for the venture capital funds

- Startups work toward a scalable business model, or high growth for their companies, targeting an exit that leads to big returns for venture capital investors (and the founders and other shareholders)

And adding the venture capital component to our definition implies requirements for companies that want to play in the startup world. A focus on acquiring venture capital means:

- A company must be formed in a way that it is “venture ready.” VCs won’t come to the table if, for example, a company was formed as an LLC instead of a corporation.

- The startup founders need to have a deep understanding of their equity ownership before they begin negotiations with VCs. Venture capitalists will negotiate for terms that favor their bottom line; founders need to ensure the cash their getting from VCs is worth the ceding of some equity and control.

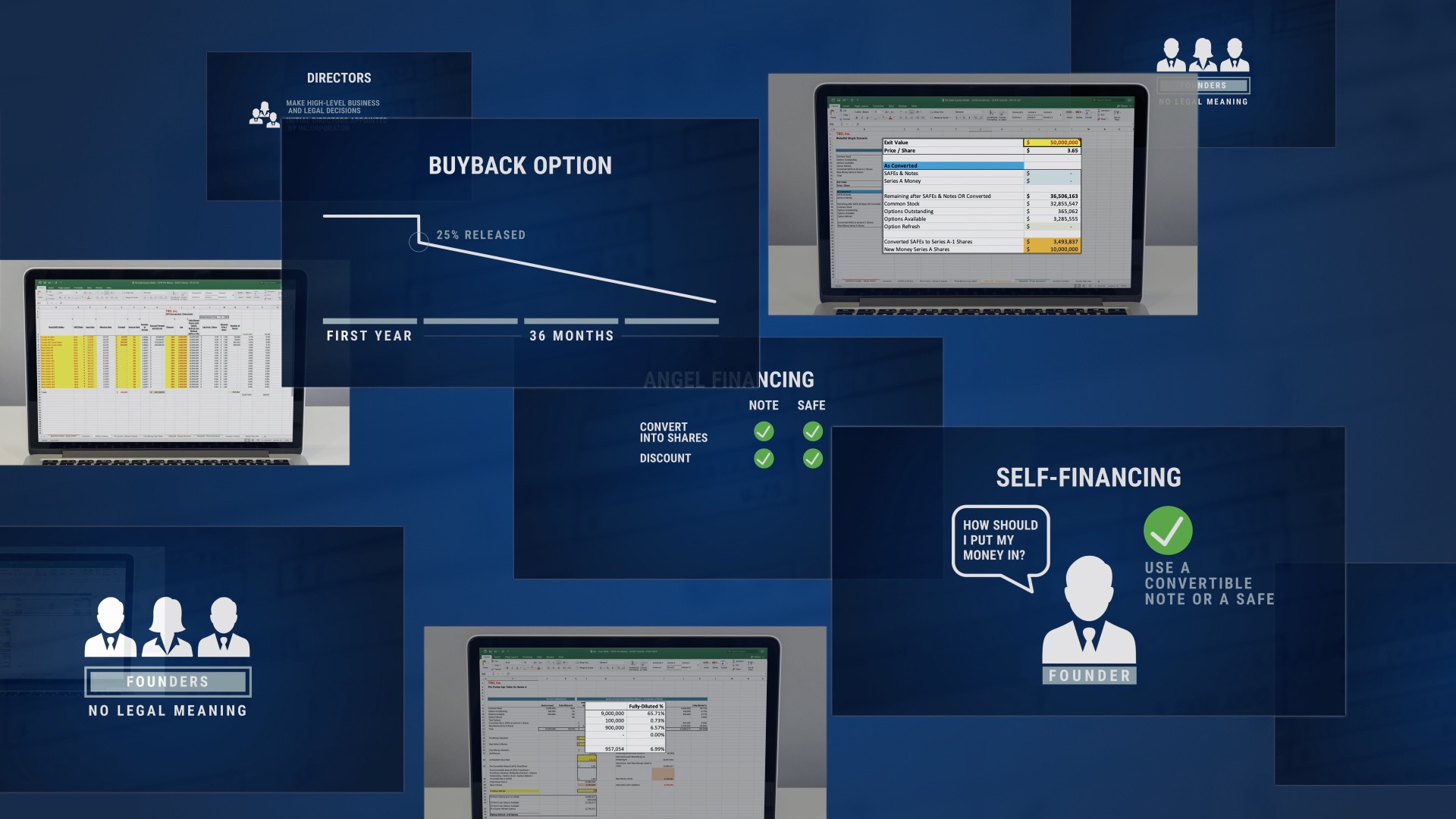

StartupProgram.com’s Cap Table, Academy, and Professional Services, are focused on these two points, ensuring that startups are prepared to negotiate with venture capitalists. Our cap table helps founders map out their stock distributions and understand the effects of venture capital investments. StartupProgram.com Academy, our exclusive online educational program, teaches entrepreneurs how to use the cap table, how to form their company in a way that makes it ready for VC investment, and the implications of selling shares to VCs.

StartupProgram.com Professional Services adds that extra confidence that everything is done right. Our supporting legal team, O&A, P.C. provides you with the experienced venture lawyers you need to review your cap table, formation documents, and confirm which tools to use when raising money. Professional Services also provides automated document generation and filing, ensuring all your formation work is done efficiently and correctly.

So if our definition of “startup” sounds like the company you’re building, we can help – even if you’re planning on disrupting something like socks.