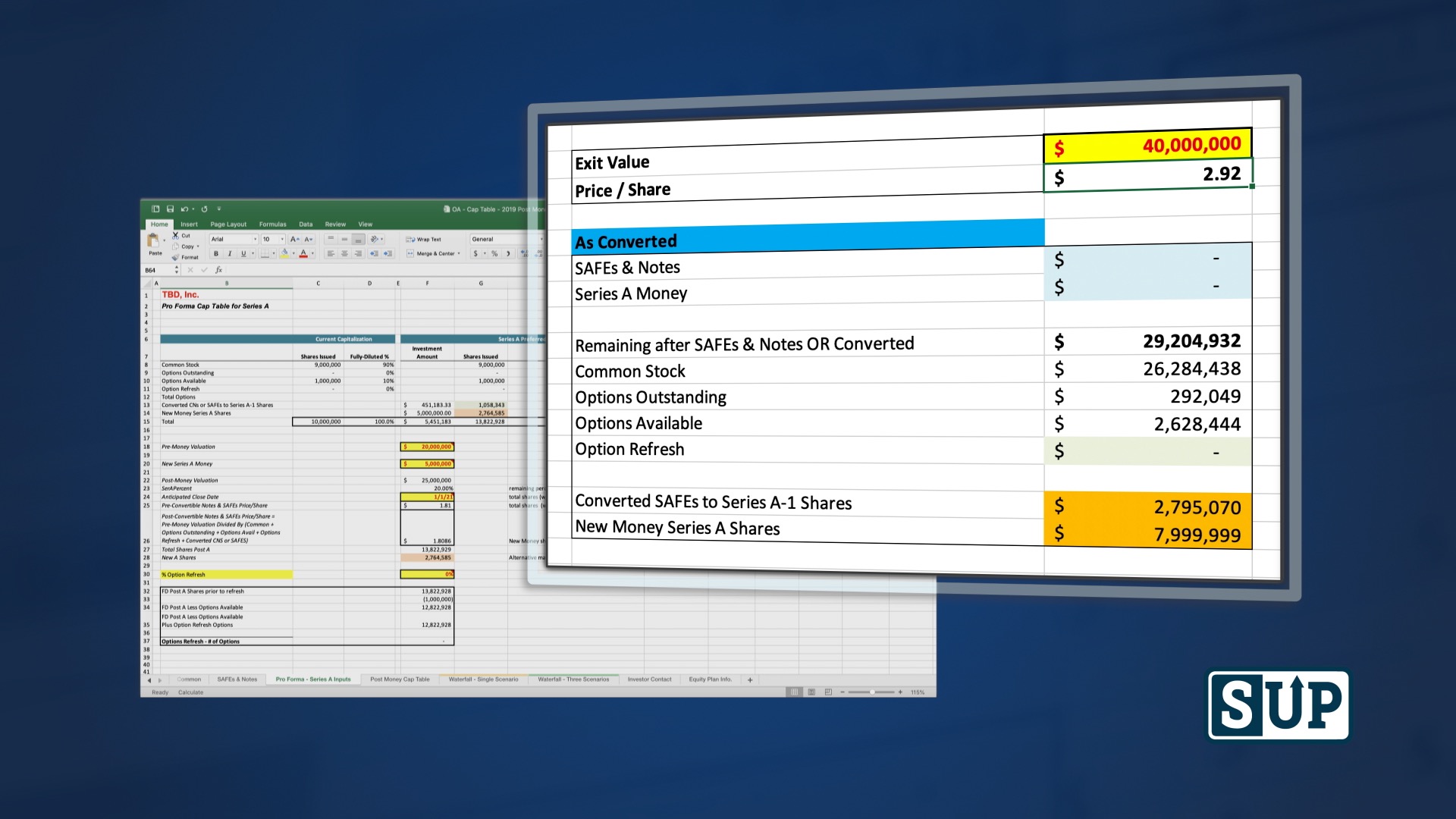

You may be thinking to yourself – why do I care about learning how to calculate issued and outstanding shares; I know how many shares I own, isn’t that enough? While knowing how many shares you own is helpful, your company’s capitalization table (“cap table”) is critical when raising money and understanding exactly how equity is allocated.

Blog

When Should a Startup Raise Venture Capital?

Cash is king and, as a pre-revenue company, raising venture capital is often a critical step in the success of your business. Even if you have friends and family willing to be your first angel investors, you can’t always count on friends and family to provide enough cash to get your company to the point of profitability. Startups burn through a lot of capital just getting off the ground and sustaining growth before they turn a profit, and so raising venture capital from sophisticated investors can be critical for feeding that initial burn.

While you may know that your business is one that could benefit from venture capital funding, or even how much you want to raise, you might not know at what point you should try to fundraise.

Why SUP and Why SUP’s Debt Equity Model (Cap Table) vs. Carta or Captable.io?

People always ask me, “What is SUP?” and “Why is its Debt Equity Model (Cap Table) relevant when I can build my cap table using an online tool?”

Here is my answer!

Stock Purchases vs. Stock Options vs. Stock Grants

Issuing stock to founders, employees, contractors, and advisors is the primary way to compensate a startup’s team when there’s little to no revenue coming in to pay salaries. That said, it can sometimes be necessary for you to explain that the value in being a shareholder doesn’t come from the value when issued, but from the value when their stock is sold – the potential of a huge payday when a stock’s value skyrockets at an exit can help attract and retain talent.

There are many ways to issue stock, and the methods and restrictions that can be put in place may sound confusing. Read on to learn about the most common ways startups get equity into the hands of founders, advisors, contractors, and employees, and how to keep each one of these people honest and committed to the success of the startup.

How Should I Raise Venture Capital and Stay Out of Legal Hot Water: The Do’s and Don’ts of asking people for money

You might not be sure where to start when attempting to raise venture capital. Your questions may include “Can I ask anyone for money?” “Can I advertise that I am looking for VC funding on social media?” “How do I ask?” “Are there any rules?” “Is it OK to ask my friends and family?” Not knowing the answers to these questions can be detrimental if you start accepting money before getting answers.

How Much Equity Do I Give to Employees, Advisors, and Contractors?

You may remember being on the receiving end of an equity grant at some point in your career and thinking about whether it was fair compensation for your services. You may even have questioned some of the details, such as the amount, vesting, or other terms of the grant when you received it, declaring it to be disproportionate to the value you brought to the company. Whatever your experience has been with equity grants, it can be an important currency in the growth of your startup that you must manage wisely as the founder(s). You will want to consider these very same questions that your own employees, advisors, and contractors may be thinking. Most importantly, you need to decide how much of your company you are willing to give to incentivize them.

How do I avoid spending too much on legal fees for my startup?

With no revenue and small early investments, new startups don’t exactly have piles of cash lying around. Meanwhile, getting operational is a cash suck that can quickly empty the company’s pockets.

As you might expect, founders of new startups are highly motivated to seek savings wherever they can. But when it comes to legal fees early in a startup’s life, it’s important to optimize your attorney time while not cutting corners that’ll lead to disaster later.

How do I raise venture capital? The Basics

Every startup begins with an idea, and soon a core team is formed to turn that idea into a business. But businesses don’t grow from an idea on enthusiasm and teamwork alone – founders will need money to scale-up, and that can make raising venture capital as important to the business as the idea.

Yes! I Was Granted Stock! Is It Taxable?

With little cash coming in the door and debt accumulating, startups do not have the means to pay big salaries to attract top tier talent and add to their headcount. That is why startups should consider adopting a stock incentive plan to compensate and motivate employees, contractors, and advisers with stock instead of salaries. Although it may mean “working for free” for now, talented employees will be enticed by the idea of owning a piece of the startup because it could mean a big pay off later when, and if, the startup has a successful initial public offering or is acquired. Although the employee, contractor, or adviser may feel like they are “working for free,” the IRS disagrees.